After an active 2015 in which such prominent payments-industry firms as processor First Data Corp. and merchant acquirer Square Inc. completed initial public offerings of stock, 2016 saw little IPO activity by payment firms. But 2017 could be a different story, according to an analyst. The most notable new U.S. …

Read More »Search Results for: card data

The Proliferation of Chatbots for Payments And Banking Begins to Raise Security Questions

An offshoot of artificial-intelligence research, chatbots emerged in 2016 as a popular technology for reaching and serving consumers for banking, payments, and shopping. Facebook’s Messenger app, which began supporting the bits of code this spring, was by September already crawling with 30,000 bots holding conversations with consumers to fulfill simple …

Read More »Bill Pay, Mobile Deposit Among the Most Popular Features of Banks’ Mobile Apps

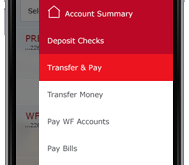

Bill payment continues to reign as the most-used payments feature of banks’ mobile apps, but mobile deposit and person-to-person payments are coming on strong, according to new findings from research firm Celent and FI Navigator Corp. The “Mobile Banking Quantified” study by Celent, a division of New York City-based of Oliver …

Read More »Chip-on-Chip Transactions Increase and other Digital Transactions News briefs

• Chip card standards body EMVCo reported that 42.4% of global general-purpose credit and debit card-present transactions from July 2015 to June 2016 involved an EMV chip card being read by an EMV-enabled point-of-sale terminal, up from 33% in the previous 12-month period. In the U.S., where the card networks’ POS EMV liability shifts took …

Read More »Canada, Too, Looks To Make Its Payments System Faster And More Efficient

Payments Canada, operator of three major payment systems in that country, issued a five-point plan Thursday to put Canada on a path toward faster and more efficient electronic payments. The plan has many similarities with efforts by Canada’s southern neighbor to modernize payments, but also some differences, according to a …

Read More »Vantiv Teams With PPRO Group To Let Web Merchants Take Payments Globally

U.S. merchants processing with Vantiv Inc. that want to court international e-commerce customers now can offer these shoppers alternative payment methods unique to their locations. Vantiv announced on Tuesday it is working with PPRO Group, a London-based payments provider, to enable non-card payment methods, such as direct debit, bank transfers, cash-based electronic …

Read More »Blackhawk Makes Apple Pay Integration and other Digital Transactions News briefs

• Cyber criminals can guess Visa card numbers and other information required for fraudulent online purchases in a matter of seconds, according to researchers. By distributing multiple guesses across many sites, the method avoids triggering automated guess limits at any single site, according to a paper in IEEE Security & Privacy, a …

Read More »How Fragile?

The ever-expanding Internet of Things could represent a back-to-the-future security nightmare for the payments industry. What’s a network without endpoints? Visa Inc. and MasterCard Inc. have big networks—about 8 million endpoints in the form of merchant locations that include point-of-sale terminals in the U.S. alone. But the Internet of Things, …

Read More »Finding the Right Word

Going too deep into the payments thicket could be a sales killer. Smart agents know when, and how, to explain certain terms. Want a sure way to stunt a sale, perhaps even ensure it can’t be closed? Start talking about payments. Yes, start throwing around the key words and phrases …

Read More »Visa’s QIR Mandate: Don’t Ask, Don’t Tell?

The new year will be ringing in with questions about Visa’s plan to improve the data-security work that third parties do on small merchants’ point-of-sale systems. What happens when a payment-security requirement isn’t enforced and is largely ignored by vast numbers of the industry participants it covers? We’re about to …

Read More »