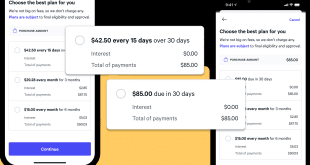

Buy now, pay later provider Affirm Holdings Inc. has expanded its payment options to include Pay in 2 and Pay in 30. The new BNPL options are intended to provide consumers with more flexibility in budgeting their monthly income, the company says. Data from the Bureau of Labor Statistics shows …

Read More »Search Results for: BNPL

It’s Time for Digital Revolving Credit

It isn’t a credit card and it isn’t BNPL. Instead, it’s the best of both worlds. As a provider of e-commerce financing solutions, we’ve watched with interest the latest calls for buy now, pay later (BNPL) transparency. We’ve also often seen this method of installment lending compared to traditional credit …

Read More »Airlines Have Plenty of Room for Growth When It Comes to Payment Acceptance, a Report Finds

Airlines face myriad challenges when it comes to improving their payment processes to drive bookings and support growth, according to a report from omnichannel payments and digital-commerce platform provider CellPoint Digital. The two leading payments challenges facing airlines are a lack of alternative payment methods and regional forms of payment, …

Read More »Embracing digital payment options and fueling payment innovation in Canada

Jon Purther, Director, Research, Payments Canada The Canadian payment landscape continues to transform rapidly, fueled by shifts in consumer and business needs and expectations and technology innovations. Looking ahead, it’s clear that continued innovation will further expand choice within the Canadian payment ecosystem. The payment preferences of Canadians Canadians …

Read More »Debit Cards Remain The Most Popular Payment Option, Especially With Younger Consumers

Despite the growing popularity of digital wallets, the vast majority of consumers prefer to pay with their debit card at the point of sale, according to research from J.D. Power. Some 72% of consumers surveyed by Power physically use their debit card at the point of sale or enter their …

Read More »Consumer Delinquencies Are Piling up As Covid Stimulus Wears Off

As the effects of the economic stimulus pumped into the economy by the federal government during the pandemic wear off, consumers are having a harder time paying their recurring debts on time. A study released Monday by Achieve, a San Mateo, Calif.-based provider of debt-management programs for consumers, reveals that …

Read More »Block Slams News Reports of a DOJ Investigation for Compliance Violations

Block Inc. chief executive Jack Dorsey fired back at news reports that the U.S. Department of Justice is investigating the company for alleged compliance lapses at Block’s Square and Cash App units. The reports “lack full context,” Dorsey said during Block’s quarterly earnings call late Thursday. News of the investigation …

Read More »16th Annual Field Guide to Innovative Payments

It’s May, and that means it’s time for our annual exercise to seek out and describe the payments players, apart from the big networks, that are rewriting the rules for the digital exchange of value. Capital One Financial Corp.’s bombshell announcement in February that it is offering to acquire Discover …

Read More »Klarna Gets Set to Launch a New U.S. Credit Card ‘Over the Next Few Months’

The buy now, pay later specialist Klarna AB signaled its intention Wednesday to issue a new credit card in the U.S. market. The company said it has opened a waitlist for the product, which it calls a “new and improved Klarna Card.” The new Visa card, which does not offer …

Read More »Eye on Fraud: Oracle Puts AI to Work Against Laundering, While the UK Works to Stop Misdirected Checks

Payments fraud takes many forms, forcing banks and processors to adopt fresh tactics. But sometimes the technology to prevent fraud can be expensive enough to wipe out any near-term expectation of return. Early Monday, Oracle Corp. launched Oracle Financial Services Compliance Agent, a platform it says can leverage artificial intelligence …

Read More »