Small-town merchants present unique challenges. Processors that can meet those needs will reap a bountiful harvest. Owning a small business in rural America comes with a lot of benefits, like a strong sense of community, loyal customers, lower costs of doing business, and less competition. However, a small-business owner in …

Read More »Search Results for: consumers

Accounting for Account-to-Account

Driven in part by the rise of open banking and real-time technology, account-to-account payments are poised to disrupt the legacy card networks. When it comes to what makes a payment option attractive to consumers and merchants, account-to-account payments have the key ingredients: real-time transfer of funds, convenience, and a lower …

Read More »No Pausing for PayPal’s Chriss

Alex Chriss took over as CEO a year ago and wasted no time shaking things up. Now he’s on a tear to spark growth. There’s no doubt Alex Chriss, PayPal Holdings Inc.’s chief executive and president since September 2023, has taken fully to heart his charge to boost the online …

Read More »Merchants: Control Your Payments Destiny

Tokenization is the key to reducing the risks posed by an ever-rising flood of data breaches. Mastercard recently unveiled plans to eliminate manual card entry for online transactions in Europe by 2030, marking another milestone for tokenization in payment processes. This change aims to not only bolster payment security, but …

Read More »The CFPB Reviews Cash Back at the Point of Sale

Retailers providing cash-back services at the point of sale fill a void for many consumers who may live in so-called banking deserts, the Consumer Financial Protection Bureau says in a recent report on the service. Some, however, charge a fee for that access, among other banking hurdles. The Cash-back Fees …

Read More »The Lesson From GPR Cards

As the payments business attracts headlines for such innovations as open banking and account-to-account transfers—and rightly so—it’s easy to forget what’s going on with some fundamental services that keep finding new uses. That’s a pity, since focusing on such products is a useful reminder of the industry’s ingenuity. Take, for …

Read More »Modern Fraud Fighting Requires a Global Approach

If fraud prevention remains tied to single regions, online payment losses will continue to mount. The global financial ecosystem has become incredibly interconnected with the growth of e-commerce, where global sales approached the $6-trillion mark in 2023. Fueled by new payment methods and categories like mobile and social commerce, online …

Read More »Unlock the Power of AI with Payarc

In today’s rapidly evolving financial landscape, integrating artificial intelligence (AI) is essential. The FinTech industry has seen dramatic changes, spurred by digitalization and the COVID-19 pandemic. At Payarc, we recognize the critical role AI plays in transforming payment processing, enhancing security, and driving growth. Let’s explore how AI can …

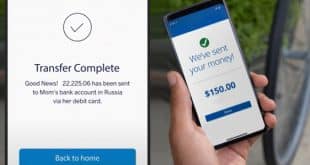

Read More »Two P2P Payments Providers Clear up What ‘Unauthorized’ Means

A fresh report from Consumer Reports finds that two of the four peer-to-peer payments companies it evaluated have cleared up the definition of “unauthorized” transactions pertaining to fraud. The publication last reviewed Apple Cash, Cash App, Venmo, and Zelle in 2022. The issue of what is an unauthorized P2P transaction gained …

Read More »PrePass Marks Integration and other Digital Transactions News briefs from 9/30/24

PrePass, a platform for highway toll payments, said its services can be accessed via an integration with the Motive Marketplace, a platform featuring artificial-intelligence capabilities. A survey of 2,600 consumers in the U.S. market and in seven other countries revealed 61% have cut back on using digital payments or otherwise changed their …

Read More »