Search Results for: fintechs

Amid Covid-19, Fintechs Use Debit to Boost Their Lending, Savings, And Investing Apps

With underbanked consumers and gig workers looking for financial products to help them track spending, create savings, and manage debt, many financial-technology companies are layering debit products onto their core application to attract and retain customers. A driving force behind fintechs’ growing fondness for debit is that it is a …

Read More »How Fintechs Can Lower Liability

The key is to review customer contracts at least annually. Here are three crucial reasons why. When used properly, litigation is an important and effective tool for enforcing a company’s contractual obligations and other rights. However, some individuals and entities misuse the legal process, bringing meritless lawsuits in an attempt …

Read More »Payments 3.0: Fintechs’ Regulatory Gray Areas

The rapid growth of payments technology has created gray areas in regulatory compliance and consumer protection, and regulators are working to catch up. The most recent example is the request for information published Feb. 26 by the Federal Deposit Insurance Corporation. The FDIC wants comments on “potential changes to its …

Read More »Eye on Fintechs; Washington’s Appetite for Regulation; Four Indicted in Equifax Breach

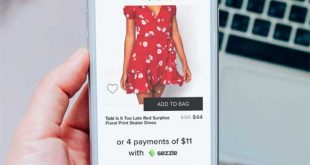

Eye on Fintechs: Sezzle Sizzles With 1 Million Users and Curve Opens a U.S. Office

Buy-now-pay-later specialist Sezzle Inc. said it surpassed 1 million consumers using its online payment service. Launched in 2016, Sezzle said it had reached 500,000 customers only in August 2019. At the end of the fourth quarter, the company, with corporate headquarters in Australia, said more than 10,000 merchants offer its …

Read More »Acquiring Banks Outdo Fintechs and Big Processors in Merchant Satisfaction, J.D. Power Finds

For all the talk about financial-technology firms and non-bank processors encroaching on banks’ turf, acquiring banks still outdo the upstarts when it comes to having satisfied merchant customers, according to J.D. Power’s first in-depth study of the merchant-acquiring industry. The online study of 3,500 small businesses nationwide last October and …

Read More »With Fast-Growing Fintechs Taking a Toll, Banks Will Soon Claim Less Than 50% of Payments Revenue

Financial institutions have been battling fast-growing fintechs and other nonbanks for payments share and revenue for years, but now new research indicates banks, which have historically controlled this crucial business, are on the cusp of slipping from that dominant perch. In 2017, U.S. banks’ total payments revenue netted out to …

Read More »Among Payments Fintechs, Software and Infrastructure Providers’ Stocks are the Priciest

Payments software and infrastructure companies rank third among 24 financial-technology sectors when viewed through the lens of stock price and earnings while point-of-sale device manufacturers rank 23rd, according to a new analysis from an investment firm. The study by San Francisco-based Financial Technology Partners covers scores of publicly traded global …

Read More »How Embedded Finance Programs Are Finding New Outlets

Talk of embedded finance, the marrying of financial services with unrelated applications for businesses, threaded through the Money 20/20 conference this week in Las Vegas, as fintechs and financial institutions devise initiatives that extend beyond simple credit and debit card acceptance. Among the latest of these is Shopify Finance, a …

Read More »