The Consumer Financial Protection Bureau on Wednesday issued an interpretive rule that buy now, pay later users are entitled to some of the same rights and protections of the Truth in Lending Act that apply to credit cards. Protections the CFPB says consumers are entitled to include the right to …

Read More »Search Results for: digital payments

Why Banks Say Sellers Are Unlikely To Pass Savings From the CCCA on to Consumers

Despite some claims to the contrary, the odds are long that merchants would pass on any potential savings to consumers from the Credit Card Competition Act, payments experts say. One argument for this is that merchants price products on a line-item basis, which means the savings on a single product …

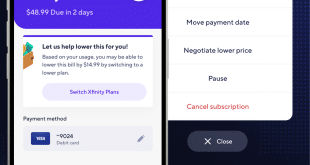

Read More »Atomic Looks to Ease the Subscription Economy for Consumers Via a New App That Works Inside Banks’ Apps

Recurring payments like subscriptions have been gaining increasing attention as more businesses supplement one-off sales and as banks and billers look for ways to automate the process for consumers within their own apps. Now the capability to make and control recurring payments is coming to consumers on their mobile phones. …

Read More »Eye on Dining POS: NCR Voyix’s QR Code App; Olo Works With MenuSifu

Point-of-sale technology for the ultra-competitive restaurant market gained even more momentum Monday as several key players unveiled new solutions. The announcements were in conjunction with the annual National Restaurant Association show taking place in Chicago. Digital-commerce technology platform NCR Voyix Corp., formerly NCR Corp., introduced its Aloha Pay-At-Table technology, an …

Read More »COMMENTARY: Why Merchants Should Embrace Network Tokenization

If you know anything about the payment space these days, you know that the natives are restless. Merchants have been fed up with interchange rates for years, with no shortage of lawsuits to voice their complaints. Even after winning the right to pass on interchange costs to the consumer, merchants …

Read More »A Bill That Would Cut the Number of Banks Covered by Durbin Advances Out of Committee

A bill containing a provision that would raise the asset threshold for debit card issuers covered by the Durbin Amendment narrowly passed in a vote late Thursday by the House Financial Services Committee. The committee voted 24-22 in favor of advancing the bill, called the Bank Resilience and Regulatory Improvement …

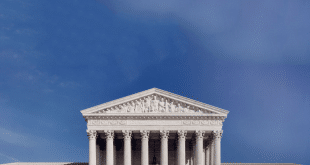

Read More »Will Its Supreme Court Victory Embolden an Already Activist CFPB?

The Consumer Financial Protection Bureau’s victory at the Supreme Court on Thursday answers for now the question of its constitutionality and may quiet the agency’s critics, who view it as a largely unnecessary agent of federal power operating with an overly aggressive agenda. But some payments experts fear the decision, …

Read More »Eye On Travel: Worldline’s Virtual Card Platform; Consumers Are Traveling More

The big processor Worldline S.A. is working with Visa Inc. to launch a virtual business-to-business card-issuing facility for online travel agencies. The deal marks the first foray for Paris-based Worldline beyond payment processing. The partnership will integrate Worldline’s Merchant Services Acceptance capabilities with its Financial Services Card issuing platform to …

Read More »Eye on ISVs: Booksy Adds Tap to Pay on iPhone; Usio Could See $20 Million in Revenue From a Single ISV

With an eye to making it easier for consumers to pay how they want, Booksy Inc., a booking platform for beauty-service appointments, is adding Tap to Pay on iPhone as an option. The contactless payment method enables consumers to use their contactless credit or debit cards, or an iPhone with …

Read More »Merchants And Banks Prepare for Battle Over the Fed’s Proposed Debit Adjustments

The National Retail Federation and the Merchants Payments Coalition have lined up against the Federal Reserve, arguing that while a rate reduction on debit card transactions is welcome, the Fed’s proposed pricing does not go far enough. The two industry trade groups sent their respective letters to the Fed on …

Read More »