Merchants and credit and debit card issuers have controlled the bulk of the narrative, pro and con, about the proposed Credit Card Competition Act since the legislation was reintroduced last year. But now a recent poll from Independent Community Bankers of America says that most consumers feel they would not …

Read More »Search Results for: retail

Mobile Wallets and Contactless Payments Growing in Popularity, NFC Forum Says

Consumers are not only favoring contactless payments more, they are relying more on their mobile wallets to initiate payments, according to the NFC Forum’s bi-annual Near Field Communication Usage and Adoption study. The study, conducted by ABI Research, reveals that 95% of respondents have left their physical wallets at home …

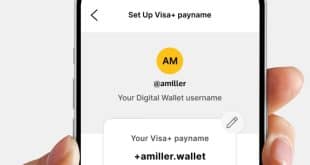

Read More »PayPal And Venmo’s Visa+ Entry Could Aid Interoperable P2P Payments

Enrolling PayPal and Venmo into the Visa+ interoperable peer-to-peer payments system may help foster even more P2P transactions, an analyst says. Visa Inc. earlier this week announced the two P2P wallets from PayPal Holdings Inc. had been enabled in the United States for Visa+. Users can sign up for a …

Read More »With a Lower Cost and a No-Chargebacks Promise for Merchants, Pay by Bank Emerges as a Fiserv Priority

Pay by bank is not a new electronic-payments concept—consumers have been paying utility bills with their bank accounts for years—but the promise of lower fees and reduced merchant headaches is energizing the service, and work is at hand developing new use cases. Witness Radial Inc., an e-commerce platform adopting Link …

Read More »What’s in Cap One’s Wallet?

Its blockbuster bid for Discover could position Capital One to compete not only with the largest credit and debit card issuers, but also with networks like Visa, Mastercard, and AmEx. Capital One Financial Corp.’s bombshell announcement in February that it is offering to acquire Discover Financial Services in all-stock deal …

Read More »Time to Embrace FedNow’s Request for Payment

The RFP is emerging as one of the most important features of real-time payments platforms. Here’s how to implement it. Request for Payment (RFP) isn’t a novel concept in banking or payments, but it will drive a lot of innovation over the next decade. Many institutions will rely on RFP …

Read More »A Signature Habit

Long unneeded in a credit card transaction, the signature at the point of sale still exists. Why? More than six years ago, the requirement that credit card transactions made at the point of sale be completed with a signature was lifted by the four U.S. card brands. But today, many …

Read More »Buying Groups Might—or Might Not—Give Merchants More Negotiating Power with the Card Networks

Card-acceptance costs and network rules weren’t the only subjects covered by the sweeping settlement revealed Tuesday involving Visa Inc., Mastercard Inc. and lawyers for the merchants that sued them. The pending agreement, which needs approval from a federal judge, allows for the creation of so-called merchant buying groups that would …

Read More »Visa And Mastercard Agree to Merchant Rate Cuts and Acceptance Changes in a Major Settlement

Merchant lawsuits challenging credit card interchange and payment card network rules that began nearly two decades ago may finally be heading for resolution under a landmark settlement announced Tuesday by Visa Inc., Mastercard Inc., and lawyers for the merchants. Merchant lawyers in the massive case estimate the settlement could save …

Read More »Breeze Taps Barclays and other Digital Transactions News briefs from 3/26/24

Breeze Airways unveiled a credit card cobranded with Barclays US Consumer Bank. The card offers triple points on purchases of airfare and other items, including in-flight items. The Brussels-based financial-messaging body Swift said early testing of its early-stage central bank digital currency shows financial institutions can process a variety of transactions through CBDCs …

Read More »