Giant processor Fiserv Inc. said its revenue from its merchant business increased to $1.85 billion in the first quarter, a 12.1% increase from $1.65 billion a year ago. Brookfield, Wis.-based Fiserv said its two other segments—financial technology and payments and networks—also had revenue increases. Revenue for the financial technology business …

Read More »Search Results for: digital payments

Eye on Tap to Pay: MagicCube Teams Up With ACI; Fiserv Offers Tap to Pay on Clover

The momentum behind tap to pay technology on smart phones shows no signs of slowing down. MagicCube Inc., which has traditionally focused on providing contactless payment technology to small merchants through off-the-shelf mobile devices, has expanded its reach to small and mid-sized merchants through a partnership with ACI Worldwide Inc. …

Read More »The ACH And Debit Top the Growth Charts, According to the Latest Fed Study

Payments analysts looking for where the growth is can find it in the automated clearing house network and in debit cards. With respect to transaction volume, no U.S. payment system grew faster over the three years from 2018 to 2021 than the ACH, which posted a compound annual growth rate …

Read More »An Upbeat AmEx Reports Record Revenue—But the CEO Remains ‘Paranoid’ About Rivals

Observers of the payments landscape who are wondering when the business will get its momentum back may have had their question answered early Thursday by the top executives of American Express Co. Travel and entertainment spending, a key category for AmEx historically and one that was hammered hard by the …

Read More »Square Launches Tap to Pay for Android in the United States And Five Other Markets

Square, the point-of-sale and e-commerce unit of Block Inc., Wednesday announced the launch of Tap to Pay on Android for merchants in the United States, Australia, Ireland, France, Spain, and the United Kingdom. The technology will enable Square merchants to accept contactless payments with a compatible Android device, such as …

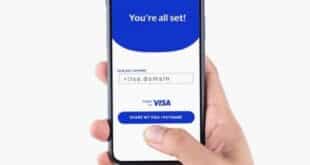

Read More »GoDaddy Enables Small Merchants to Ditch the Dongle With the Addition of Tap to Pay for iPhone

Web registrar GoDaddy Inc. continued its push into payments Monday by adding Apple Inc.’s Tap to Pay on iPhone to the GoDaddy Mobile App. The inclusion of Tap to Pay on the GoDaddy app will enable small businesses to accept contactless payments on an iPhone without a dongle. Merchants need …

Read More »Early Warning Reports Double-Digit Volume Growth in the First Quarter

Early Warning Services LLC Monday morning issued a report from its chief executive reporting significant first-quarter growth for the company’s Zelle peer-to-peer payments network and underscoring efforts by EWS, owned by seven of the nation’s biggest banks, to combat fraud and scams. Though the report, signed by four-year CEO Al …

Read More »Chargebacks911 Responds to Allegations it Undermined Chargeback Disputes

Responding to allegations by the Federal Trade Commission and Florida’s attorney general that it used multiple techniques to prevent consumers from winning chargeback disputes, chargeback-management company Chargebacks911 on Friday released a statement saying the charges are unfounded. The FTC and Florida attorney general Ashley Moody sued Chargebacks911 on Wednesday alleging …

Read More »Will Visa’s 3% Surcharge Cap, Set for April 15, Push Merchants to Cash Discounts?

Visa Inc. is poised to lower on Saturday the amount a merchant can surcharge for transactions on its credit cards from a maximum of 4% to 3%, a move it announced early this year. Some observers acknowledge the reduction will happen, though Visa Inc. has not responded to Digital Transactions …

Read More »As P2P Transfers Rise Via Apps, Visa Responds With an Interoperability Play

The payments industry continues to reckon with the myriad ways the pandemic has permanently reshaped how people pay businesses and other people. One key example is how individuals are paying each other compared to just a couple of years ago, and how payment networks are responding. In just the two …

Read More »