Pressure from the Senate Banking Committee on Early Warning Systems LLC, operator of the Zelle peer-to-peer payment network, is rising as committee members continue to press Early Warning for information about the extent of fraud on the network. A report released by Sen. Elizabeth Warren’s office late Monday charges that …

Read More »Search Results for: BNPL

Cloud: The Engine of Innovation

Here’s why payments providers can no longer afford to ignore or misunderstand cloud technology. Cloud is a key factor in the expected growth of the digital-payment gateway market to $416 billion by 2024. Non-bank players, from big tech to e-commerce giants to fintech startups, are leveraging the fearsome capabilities of …

Read More »Travel Now, Pay Later

Vacation and hospitality booking is the next wave in BNPL. Picture this. You’re on the beach. The sun is shining and the luxury resort you’re staying at is the farthest from home you’ve been in nearly two years. But you don’t worry about how much it costs. That’s because you, …

Read More »In a Payments Industry First, Usage of Debit Cards Tops That of Credit Cards

Consumers’ usage of debit cards has finally surpassed that of credit cards. Through the second quarter of 2022, 56.2% of consumers preferred debit as their primary payment card, compared to 39.5% for credit, according to a report from S&P Global Market Intelligence. Those numbers represent a dramatic change in the …

Read More »Fiserv Tweaks Carat Data Access And Other Digital Transactions News briefs from 9/29/22

Fiserv Inc. said its Carat operating system has added a capability for large enterprises to more readily access and analyze payments data.Mastercard Inc. said it is launching Strive USA, a small business imitative, in the United States for the first time. The goal is to support 5 million SMBs over the next five years.Also, …

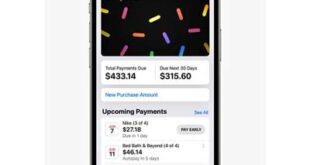

Read More »One More Thing? Apple Pay Later’s Debut Is Still Pending

Apple Inc.’s latest financial product, a buy now, pay later service called Apple Pay Later, has yet to arrive, though the iPhone operating system it was expected to require launched Sept. 12. Why is that? One Bloomberg columnist suggests Apple Pay Later, which was announced in June, may not arrive …

Read More »Four Trends Are Affecting U.S. Retail, a Checkout.com Report Finds

Everybody knows the U.S. retail arena is changing, but a new report from Checkout.com reveals that four trends, among them the growth in digital payments, currently are most affecting it. Rising prices, consumers seeking new shopping channels, and increased competitiveness are the other three trends altering the retail landscape. United …

Read More »Affirm, Amazon Mark Canada Expansion And Other Digital Transactions News briefs from 9/22/22

Affirm Inc. expanded its installment payment service with Amazon.com Inc. to consumers in Canada.Digital personal finance provider Achieve said the percentage of Achieve users with buy now, pay later accounts on their credit reports grew 58% in June compared to January 2021.The “2022 State of Credit” report from Marqeta Inc. found that 64% of BNPL users reported …

Read More »Flexbase Technologies Brings Buy Now, Pay Later To B2B Transactions

Seeking to carve out a slice of business-to-business sales, Flexbase Technologies Inc., a San Francisco-based fintech that provides financing technology to businesses, has launched a buy now pay later app for the B2B market. The app, called Flexbase Pay, provides a fresh twist on the traditional net-60 credit terms in …

Read More »The CFPB’s Buy Now, Pay Later Report Offers a Regulatory Outline, But No Sweeping Overhaul

Long anticipated, a report from the Consumer Financial Protection Bureau offers suggestions on how regulation might aid the buy now, pay later industry, but doesn’t recommend a wholesale review of its practices. Among the risks outlined in the “Buy Now, Pay Later: Market trends and consumer impacts” report, released Thursday, are …

Read More »