In response to consumer demand to use buy now, pay later installment loans for higher-ticket purchases, such as home furnishings, the big BNPL player Afterpay has increased its credit limits and repayment periods. Afterpay users can now take out BNPL loans for purchases of between $400 and $4,000 and repay …

Read More »Search Results for: pay by link

Boston Consulting Group: Payments Revenues Will Stay Resilient Despite Headwinds

Despite economic headwinds from supply-chain bottlenecks and geopolitical instability, the payments industry continues to show resilient revenue growth, says a new report from the Boston Consulting Group. Global payments revenues are projected to grow about 9.5% in 2022, according to the report. Beyond this year, revenues are projected to grow …

Read More »The Brewing Rivalry for Real-Time Payments

The Fed will debut FedNow next year. It will face a highly complex—and surprisingly competitive—market for the instant transfer of value. In the near future, most people will be able to exchange money instantly anywhere, any time. A patchwork of competing and collaborating national and multinational instant-payment systems with very …

Read More »In a Payments Industry First, Usage of Debit Cards Tops That of Credit Cards

Consumers’ usage of debit cards has finally surpassed that of credit cards. Through the second quarter of 2022, 56.2% of consumers preferred debit as their primary payment card, compared to 39.5% for credit, according to a report from S&P Global Market Intelligence. Those numbers represent a dramatic change in the …

Read More »Circle Looks to Its Deal for Elements to Ease Crypto Payments for Merchants

Blockchain players have been working for years to bring digital currencies to the point of sale, leading to Circle Internet Financial LLC’s announcement Thursday it has acquired a San Francisco-based payments-technology firm called Elements to make it easier for stores to take crypto, including Circle’s stablecoin, USD Coin (USDC). Terms …

Read More »Elavon Launches a Platform for Contactless Payments in Mass Transit

The big payments processor Elavon Inc. has joined the movement to convert mass transit in the United States to contactless technology for fare transactions. The Atlanta-based company on Tuesday launched its Mass Transit Payments platform, aimed at both public and private agencies and with gateway and acquiring services provided by …

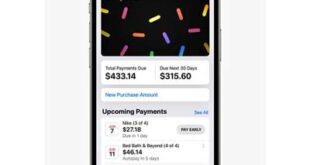

Read More »One More Thing? Apple Pay Later’s Debut Is Still Pending

Apple Inc.’s latest financial product, a buy now, pay later service called Apple Pay Later, has yet to arrive, though the iPhone operating system it was expected to require launched Sept. 12. Why is that? One Bloomberg columnist suggests Apple Pay Later, which was announced in June, may not arrive …

Read More »Eye on BNPL: Square’s Afterpay Marks Canada Debut; Allegiant Taps Uplift

Square, the payment-processing unit of Block Inc., is integrating its Afterpay buy now, pay later service into its e-commerce products across Canada. Meanwhile, airline Allegiant introduced Allegiant Pay Powered by Uplift for flights, hotels, and car-rental bookings made by its customers. Uplift is a travel-specific buy now, pay later provider. …

Read More »Flexbase Technologies Brings Buy Now, Pay Later To B2B Transactions

Seeking to carve out a slice of business-to-business sales, Flexbase Technologies Inc., a San Francisco-based fintech that provides financing technology to businesses, has launched a buy now pay later app for the B2B market. The app, called Flexbase Pay, provides a fresh twist on the traditional net-60 credit terms in …

Read More »The CFPB’s Buy Now, Pay Later Report Offers a Regulatory Outline, But No Sweeping Overhaul

Long anticipated, a report from the Consumer Financial Protection Bureau offers suggestions on how regulation might aid the buy now, pay later industry, but doesn’t recommend a wholesale review of its practices. Among the risks outlined in the “Buy Now, Pay Later: Market trends and consumer impacts” report, released Thursday, are …

Read More »