Top executives with FIS Inc. spent a good deal of time Thursday morning countering what they said is a “bear case” that has developed among at least some investors and observers of the company. “The bear case is that FIS is standing still and not able to compete. This is …

Read More »Search Results for: digital payments

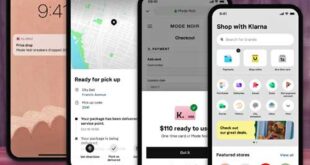

Klarna Launches a New App That Brings BNPL Capability to Any Online Store

Two trends have buoyed the payments business since the onset of the pandemic—online shopping and buy now, pay later capability—and on Wednesday Klarna AB launched a new app that exploits both trends by letting consumers use Klarna’s BNPL service regardless of whether the store is a Klarna merchant. The new …

Read More »Consumers Intend to Embrace BNPL As Never Before This Holiday Shopping Season

Heading into the holiday shopping season, consumers are poised to make even more use of buy now, pay later options than in the past. Overall, 42% of consumers plan to use BNPL while holiday shopping, according to a survey by GoCardless, a provider of account-to-account payments. When Millennials were asked …

Read More »Eye On BNPL: ACI Partners With Affirm; Afterpay’s Holiday Shopping Survey

ACI Worldwide Inc. added to its growing list of buy now, pay later partners on Monday, announcing a deal with Affirm Inc. Merchants using the processor’s ACI Secure eCommerce solution can offer consumers the ability to make purchases with Affirm and split the cost of the purchase into biweekly or …

Read More »Open Banking Is Due for Explosive Growth, Posing a Threat to Cards, a New Report Says

The rising prominence of open banking, particularly in Europe and the United States, poses a “growing threat to the dominance of cards within e-commerce,” says a report released early Monday by the United Kingdom-based firm Juniper Research. The report comes against a backdrop in which e-commerce transactions are growing fast …

Read More »The Myth of the Super App

Another sort of unicorn. Here’s why it’s more accurate to speak of super-power apps. Mobile payments in the United States remain a minority, accounting for just under 4% of all payments made in-person. Even worse, 25% of U.S. consumers are still using paper forms of payment, including checks. Fintech-supplied bank accounts …

Read More »New Twists in Online Fraud

No longer content to use a stolen credit card, criminals are targeting e-commerce merchants for everything from customer account data to loyalty points to BNPL fraud. Criminals follow the money, and, with e-commerce booming and more merchants selling online than ever before, it’s no surprise that fraudsters are flocking to …

Read More »Attrition’s Complex Calculus

Merchant attrition is actually a little lower than it was before the pandemic. But don’t get too excited. The total picture is a little more complicated than that. First, the good news. Merchant attrition, expressed as a percentage of all accounts with $5 million or less in annual credit and …

Read More »AmEx’s New Debit Card Is Part of a Big Thrust Commercial Banks Should ‘Watch Closely’

With its launch on Thursday of a digital checking account for business and an associated debit card, American Express Co. could be poised to shake up the payments business in ways not seen before, observers say. “This announcement represents the greatest threat to financial institutions who are competing for the …

Read More »COMMENTARY: Are You Asking the Right Questions to Decide on a Payment Operating Model?

Companies offering payment solutions generally face an important decision in their early days: settling on the right operating model. Should we function as a payment facilitator (payfac) and do everything ourselves? Should we register as an acquirer, ISO, or third-party processor? Should we handle risk and underwriting? How should we …

Read More »