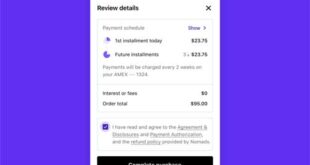

Buy Now Pay Later (BNPL) options have become a staple in the E-commerce marketplace, mostly because they provide merchants and their customers an attractive and flexible alternative to credit cards. This has proven particularly appealing to younger shoppers such as Millennials, or Generation Z consumers up to 24 years old. …

Read More »Search Results for: BNPL

Afterpay’s Rewards Program Grows and other Digital Transactions News briefs from 6/29/21

Buy now, pay later specialist Afterpay Ltd. expanded its points-based Pulse Rewards program to all users. The company claims 17 million users in North America.Rival BNPL specialist Klarna AB announced it will offer financing to client merchants through business-finance platform Liberis Ltd.Rectangle Health, a payments provider specializing in doctors’ offices, is working with DoctorLogic …

Read More »Slice Payments on the Menu for Pizzerias and other Digital Transactions News briefs from 6/28/21

Slice, which provides an ordering and payment app for independent pizzerias, added Slice Payments as an in-store payment platform. Slice Payments can be used with Slice Register, its point-of-sale service, or as a standalone option.Splitit Inc., a U.S. buy now, pay later provider, said it will integrate its installment-payment platform with tabby, …

Read More »Eye on Acquiring: Shift4 Reaches $1 Billion in Weekly Volume; Nuvei Recruits Discover

Shift4 Payments Inc. on Tuesday announced it had reached a key milestone as it is now processing at least $1 billion per week in what it calls end-to-end payments volume. Shift4 earns more on end-to-end volume, which it processes itself, than on gateway traffic, which it passes off to other …

Read More »Shopify And Affirm Open Buy Now, Pay Later to U.S. Sellers Via Shopify Installments

With e-commerce sales booming, payments players are looking for combinations that can keep online customers engaged and add even more buyers to their ranks. An example emerged Thursday morning as Shopify Inc. and Affirm Inc. announced Affirm’s buy now, pay later service is now available to “hundreds of thousands” of U.S. …

Read More »Repay To Acquire BillingTree and other Digital Transactions News briefs from 5/11/21

Repay Holdings Corp. said it is acquiring BillingTree, which provides payment services to the healthcare, credit union, accounts receivable management, and energy industries, for $503 million. BillingTree was founded in 2003. Repay also released its first quarter results with $47.5 million in revenue, a 20.3% increase from $39.5 million in the 2020 first …

Read More »13th Annual Field Guide to Innovative Payments

It’s May, and that means it’s time for our annual exercise to seek out and describe the nonbank players, apart from the big networks, that are rewriting the rules for the digital exchange of value. Since 2004, Digital Transactions has traced the course of payments innovation through its nimblest practitioners—the …

Read More »The Skunk at the Party

The craze for point-of-sale installment lending—a trend popularly known as buy now, pay later—has enjoyed a honeymoon among merchants and consumers alike. The option, which lets consumers receive the goods in their cart but pay for them later over a few interest-free installments, came along just as pandemic fears threatened …

Read More »Where To Buy an RV With Crypto and other Digital Transactions News briefs from 4/26/21

Camping World Holdings Inc. said it will begin accepting cryptocurrency for payment for recreational vehicle purchases through processor BitPay Inc.Buy now, pay later provider Splitit Inc. said its year-to-date merchant sales volume is up almost 250%, at $82 million, over the same period last year, following rising adoption by shoppers and merchants.In related …

Read More »North America Becomes Afterpay’s Largest Market for its Buy Now, Pay Later Services

North America has emerged as the largest sales-generating region for buy now, pay later provider Afterpay Ltd. In the Australia-based company’s latest financial results, North America sales accounted for A$2.6 billion (US$2 billion) in the third quarter ended March 30. Only Australia and New Zealand approach that volume. Overall, Afterpay said …

Read More »