As the Federal Reserve’s real-time payments network celebrates its first birthday, the payments industry takes stock of its impact on instant transfers. Launched with great fanfare in July 2023, the widely and long-anticipated FedNow has largely enjoyed a successful first year. One area where the network has excelled is in …

Read More »Search Results for: fintechs

The Ingredients of Success

The contrast between the approach in the U.S. and that in Europe underscores the importance of competition and innovation. Many U.S.-domiciled payment networks are relevant, even dominant, globally, whereas few European payment systems are. Europe and the United States are both served by a patchwork of retail, peer-to-peer, and interbank …

Read More »Amazon Gives Visa’s BNPL Offering A Huge Boost In Canada

Visa Installments, Visa Inc.’s buy now, pay later platform, received a huge lift Thursday with the announcement that Amazon.com will offer the payment option to Canadian consumers. The payment option, which is being marketed in Canada as “Installments enabled by Visa,” has until now been available only through 100 Canadian …

Read More »Many Opt for Manual Bill Pay and other Digital Transactions News briefs from 5/30/24

Almost two-thirds of U.S. consumers prefer to pay bills manually rather than through automated services, according to a survey by payments platform MX Technologies Inc. The online research embraced 1,059 adults and was conducted during the first quarter. Embedded payments startup Forward closed a $16 million seed financing round led by Commerce Ventures, Elefund, …

Read More »MagTek Teams with KwikPOS on Handheld Device and other Digital Transactions News briefs from 5/17/24

Point-of-sale technology provider MagTek Inc. said it has worked with KwikPOS, a developer of POS systems for restaurants, to develop a handheld device that links to MagTek’s gateway and uses the company’s mobile card reader. Tassat Group Inc., a real-time settlement platform based on blockchain technology, announced it will work with cross-border …

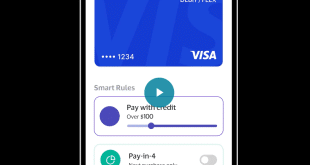

Read More »Visa Revamps its Payments Approach

Visa Inc. is taking up the notion of a digital payment identity and making it part of its product mix. Announced Wednesday at the Visa Payments Forum in San Francisco, the Visa Flexible Credential is but one of several products the payments network formally debuted, including broader tap-to-pay capabilities, a …

Read More »Supreme Court Upholds CFPB Funding and other Digital Transactions News briefs from 5/16/24

The U.S. Supreme Court early Thursday upheld the constitutionality of the Consumer Financial Protection Bureau by a 7-2 vote, reversing an October 2022 ruling by a federal appeals court in New Orleans that had held the means by which the bureau is funded violates the U.S. Constitution. The CFPB, created in 2008, receives its …

Read More »16th Annual Field Guide to Innovative Payments

It’s May, and that means it’s time for our annual exercise to seek out and describe the payments players, apart from the big networks, that are rewriting the rules for the digital exchange of value. Capital One Financial Corp.’s bombshell announcement in February that it is offering to acquire Discover …

Read More »Eye on BNPL: Splitit Rolls Out Installment Loans At Checkout; Klarna Partners With Uber

Buy now, pay later provider Splitit Payments Ltd. has launched an installment-payment option for financial institutions that consumers can access at the point-of-sale. Financial institutions can offer the option by connecting directly to Splitit’s merchant networks, through a direct link or through a card network. The payment option, called FI-PayLater, …

Read More »Steady Consumer Spending Helps Buoy Visa As It Strikes Deals for Open Banking

Citing “relative stability” across key business metrics, such as cross-border volume, Visa Inc. late Tuesday reported March-quarter increases of 10% year-over-year in both net revenue ($8.8 billion) and net income ($4.7 billion). Driven by stable consumer spending, dollar volume grew 8%, while total cross-border dollar volume grew 16% and processed …

Read More »