Payments provider Paya Inc. has agreed to supply point-of-sale systems supplier 1Retail with technology that enables EMV contactless and stored payments in enterprise resource planning (ERP) software from Acumatica Cloud. The deal provides Paya’s and 1Retail’s mutual customers running the Acumatica ERP platform with a POS system that works in …

Read More »Search Results for: pay by bank

Fraud on P2P Networks Hits 12% of Bank Customers in the U.S., J.D. Power Finds

Some 12% of U.S. customers have lost money to fraud on a peer-to-peer payment network, while 11% have seen it happen to a family member, according to survey results released earlier this month by J.D. Power. The networks cited by the respondents were Zelle, Venmo, and PayPal. For the survey, …

Read More »Study: Peer-to-Peer Payments Are Key To Financial Institutions’ Payment Strategies

As financial institutions look to revamp their payment strategies, peer-to-peer payments are expected to play a key role, says a report from Cornerstone Advisors. During the past three years, nearly 30% of community-based financial institutions have replaced their P2P service or selected a new one, and about one in five …

Read More »COMMENTARY: Apple Pay Later Is Set to Trigger a Domino Effect in the BNPL World

The interest in buy now, pay later (BNPL) skyrocketed in 2021 and 2022: Millions of people have turned to this installment-payment solution for its convenience, flexibility, and simplicity. So it’s no surprise that Apple announced its new BNPL product, Apple Pay Later, in June. With its new financial service, the …

Read More »Eye on Cannabis: Merrco Brings BNPL to Cannabis Sellers; Aeropay Partners with HighHello

Toronto-based Merrco Payments Inc., which specializes in cannabis-payments processing, is partnering with buy now, pay later provider Gratify Payments Inc. to enable cannabis merchants in Canada to offer BNPL loans as a payment option. Offering the installment payments is expected to help Canadian cannabis merchants upsell customers on accessories and …

Read More »COMMENTARY: How Banks And Credit Unions Can Create a Top of Wallet Experience for Consumers

As the holiday season continues and the cost-of-living rises, shoppers are searching for meaningful yet budget-friendly gifts for loved ones. Consumers need financial flexibility to make large purchases without using their entire paycheck to do so. Buy now, pay later solutions continue to rise in popularity as consumers search for …

Read More »Eye on E-Commerce: GoDaddy’s Platform for WordPress, And Aeropay’s Mosaic Move

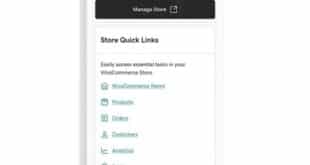

The big Internet services provider GoDaddy Inc. said on Tuesday it is using its Manage WooCommerce Stores technology to help sellers open and manage a store on the WordPress online platform. The move, which could bring more small sellers into the e-commerce fold, is aimed at untangling the complexity GoDaddy …

Read More »Looking to Sharpen Its Edge in Merchant Services, NMI Acquires Agreement Express’s Payments Assets

Payment platform provider NMI has acquired Agreement Express Inc.’s merchant onboarding, underwriting, and monitoring technologies. The acquisition, which is for the payments portion of Agreement Express’s total business, is aimed at allowing NMI to provide integrated software vendors, independent sales organizations, and fintechs with tools that can speed up merchant …

Read More »Real-Time Payments Will Grow Nearly 300% Over the Next Five Years, Juniper Predicts

The growth of real-time payments over the next five years will gain momentum from cross-border transfers in a global economy, according to research released early Monday. Indeed, the total number of real-time transactions, also known as instant payments, worldwide will reach 376 billion in 2027, up 289% from 97 billion, …

Read More »COMMENTARY: How Banks Can Win Against the BNPL Threat

Buy now pay later (BNPL) solutions have seen steady growth over the past few years. The lack of regulations and consumer protections have allowed financial institutions to maintain an edge in this product. But for how much longer? BNPL is now threatening the status quo, with 57% of customers saying …

Read More »