Business-to-business bill-payments provider Billtrust announced its dollar volume in 2022 exceeded $100 billion, up 35% over 2021 and the first time the company has reached the $100-billion mark in a year. PayTech Women, formerly Wnet, released its 2022 Annual Report, which provides an overview of the organization’s activities and impact. General Agents …

Read More »Search Results for: retail

Wait No More: Apple Pay Later Arrives a Bit Late

Apple Inc.’s newest financial product, a buy now, pay later service called Apple Pay Later, has finally arrived. Launched Tuesday, Apple Pay Later was announced in June, but only now is it being made available, and just to a limited set of Apple Pay users. Apple says it will offer broader …

Read More »What to Expect from the Payments Market in 2023

Written by John Ruthven, IR CEO and Managing Director The digital payments industry is undergoing a massive transformation fueled by accelerated technological advancements and growing customer demand. The market is expected to be worth US$19.89 trillion by 2026, representing a compound annual growth rate (CAGR) of 24.4%, according to …

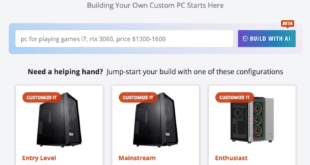

Read More »Eye on Commerce: 81% of Consumers Want ‘Just for Me’ Shopping; Newegg Adopts ChatGPT

What’s the future of shopping going to be like? If consumers have their way, it will be more personalized and convenient, found the “Future of Shopping” report from Synchrony. And online retailer Newegg Commerce Inc. is incorporating artificial intelligence tool ChatGPT into its shopping protocols. With increased sophistication in personalization, …

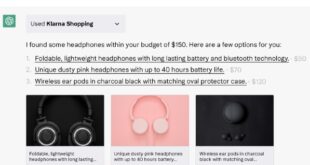

Read More »Klarna Adds ChatGPT as an Enhancement to Online Shopping

ChatGPT, the artificial intelligence-based chatbot developed by OpenAI, is being rolled out by Klarna AB to provide what the payments platform calls personalized and intuitive shopping experiences. Online shoppers will be able to ask Klarna, through the chatbot, for product recommendations, as well as receive links to shop recommended products …

Read More »Fiserv Teams Up With Central Payments to Deliver Banking-as-a-Service to Fintechs

Fiserv Inc. is partnering with Central Payments LLC, a provider of banking-as-a-service for fintechs and embedded-finance businesses, to enable fintechs to bring financial products and services to market faster. Central Payments will leverage Fiserv’s real-time card-processing and -issuance capabilities to enhance its Open CP Fintech API Marketplace, a banking-as-a-service platform …

Read More »Silvergate To Wind Down And Other Digital Transactions News briefs from 3/9/23

Silvergate Capital Corp. said it will wind down its operations and return deposits to customers after it was forced to sell assets at a loss. Silergate last year acquired the assets of stablecoin venture Diem Group, formerly known as Libra. U.S. retail sales in February, excluding automotive, were up 6.9% from February 2022, …

Read More »Amazon Expands Its ‘Just Walk Out’ Store Technology to College Campuses

In an expansion of the Just Walk Out technology that powers cashierless Amazon Go stores, Amazon.com Inc. is partnering with Transact Campus Inc., a provider of campus identification systems that enable student access to buildings and payments for such campus services as dining, laundry, and vending. Under the terms of …

Read More »Fintechs Eat into Bank Payments Volume And Other Digital Transactions News briefs from 3/8/23

Among some 108 banks in North America, Europe, and Asia-Pacific, nearly half indicate they have lost at least 10% of their payments volume to fintechs, according to an Aite-Novarica report supported by payments platform Finastra. As a result, some 65% plan to make a significant or moderate investment in payments technology …

Read More »Embedded Banking Solutions Are Assuming a Higher Profile for Software Vendors

Businesses are increasingly looking for software developers that can integrate payments and other traditional banking products and services and generate new revenue for the platforms that offer them, according to a recent report from The Strawhecker Group (TSG) and KeyBank. The trend, known as embedded banking, is a way for …

Read More »