U.S. Bancorp, owner of the big merchant acquirer Elavon Inc., generated 36% of its first-quarter non-interest income from payments, according to the Minneapolis-based company’s first-quarter earnings report released Wednesday. U.S. Bancorp reported $849 million of its total $2.33 billion in non-interest income came from payment sources such merchant fees, interchange …

Read More »Search Results for: digital payments

Surcharging Programs May Appeal to Merchants, But ISOs And Acquirers Like Them, Too

Offering a surcharging or cash-discounting program to merchants has obvious revenue benefits to merchants, but they have the potential to grow an independent sales organization’s or acquirer’s bottom line, too. Such programs enable merchants to cover their costs to accept credit card transactions by adding a fee to the purchase …

Read More »PayPal Furthers Its In-Store Ambitions With Deals With Android Pay And Wells Fargo

When PayPal Holdings Inc. made deals last year with Visa Inc., Mastercard Inc., Citigroup Inc., and Fidelity National Information Services (FIS), one key part of the agreements was access to the card networks’ tokenization engines to reach bank-issued payment cards. On Tuesday,

Read More »Set on Claiming a Big Piece of the P2P Pie, Zelle Touts Members’ Volume Already in Hand

Financial institutions are determined not to be left behind as mobile person-to-person payments gain popularity and non-bank players invade the market. On Monday, Early Warning Services LLC, a company controlled by some of the nation’s biggest banks, said its Zelle P2P service has grown to include 20 banks and credit …

Read More »Merchants And Issuers Alike Will Need Persuading on the New 3-D Secure 2.0

In the run up to full implementation of 3-D Secure 2.0, a payment standard that aims to curb online fraud and prevent blocking legitimate transactions, merchants and issuers alike will need some convincing the technology will not impede e-commerce and mobile commerce. That’s the word from Tim M. Sherwin, chief …

Read More »Under New Leadership, Klarna’s U.S. Unit Targets Impatient Users With Streamlined Credit

Klarna Inc.’s new boss has big ambitions. Jim Lofgren, vice president of global accounts and partnerships for the Swedish payments processor’s U.S. operation, tells Digital Transactions News there’s plenty of room for growth in what many might perceive as a saturated market for retail credit. “In the U.S., we see …

Read More »ACH Volume Growth Again Surpasses 5% To Hit 25.6 Billion Transactions in 2016

Automated clearing house volume grew by more than 1 billion transactions in 2016, ACH network governing body NACHA reported this week. Herndon, Va.-based NACHA says traffic on the network, which connects virtually all U.S. financial institutions, hit 25.6 billion transactions, up 5.3% from 2015. That grand total includes on-us transactions. …

Read More »Globally, the ‘Pays’ Ring up Eye-Popping Growth. But In the U.S., It’s a Different Story

Mobile-wallet enthusiasts may have to look overseas for encouragement. A report released Tuesday indicates sizzling growth worldwide for the three major mobile-payments services—Android Pay, Apple Pay, and Samsung Pay—but researchers who follow the U.S. market say the trio are making little if any headway with consumers. The report from Juniper …

Read More »OptBlue Acquirers Signed 1 Million Small Merchants for AmEx in 2016

Bank card merchant acquirers participating in American Express Co.’s OptBlue program signed 1 million small businesses for AmEx acceptance last year, an AmEx executive tells Digital Transactions News. The push came as New York City-based AmEx drives toward chief executive Kenneth I. Chenault’s goal of having AmEx’s merchant base reach …

Read More »With Interac’s Real-Time Network Volume Up 50% in 2016, More Services Are on the Way

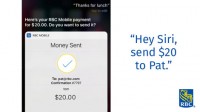

Interac, the Canadian debit network, says a record number of payments were made in 2016 using e-Transfer, its money-transfer service. Transactions totaled 158 million, up 50% from the 2015 total of 105 million. The total value of these transactions reached C$63 billion (US$47.3 billion) in 2016 with an average transaction …

Read More »