The movement to speed up cross-border payments received another boost Monday as Mastercard Inc. announced the integration of Mastercard Cross-Border Services, the card network’s global push payments platform, with Previse Ltd.’s InstantPay platform. The cross-border payments integration, which leverages machine learning, will enable companies to identify invoices likely to be …

Read More »Search Results for: pay by link

Visa’s Latest Debit Card Perk Is Eligibility for ReadyLink, its Prepaid Reload Network

In a move aimed in part at accommodating digital-only financial institutions, Visa Inc. on Saturday opened its ReadyLink prepaid top-up network for the first time to debit cards. “The expansion makes Visa ReadyLink available to all consumer and business debit cards. The service is optional and issuers need to opt-in,” …

Read More »KyckGlobal Enables Echo Health To Digitize Claims Payments

As part of its strategy to automate payouts for health-care and property-and-casualty carriers, Echo Health Inc., a provider of payment technology to insurance carriers, is partnering with KyckGlobal Inc. to enable claimants to receive payments digitally through PayPal, Venmo, push to card through Visa Direct, and the automated clearing house. …

Read More »Eye on BNPL: Bonsai, Afterpay Ease Shopping on Publisher Sites; Opy USA’s Pay by Text Service

Shop Bonsai Inc., which provides in-app checkout technology under the Bonsai moniker, said it and buy now, pay later specialist Afterpay are making it easier for consumers to shop on an online publisher’s site without leaving the site. Announced Wednesday, the arrangement enables Bonsai shoppers to potentially reduce the checkout …

Read More »Computop Leverages NFC Tags to Enable Mobile Contactless Payment Without An App

NFC tags, a technology commonly used to enable contactless payments through a mobile device at the pump and at vending machines, are making their way to the physical point-of-sale. Computop, a Bamberg, Germany-based provider of omnichannel and fraud-prevention solutions, announced on Tuesday Computop Close-by, a payment solution that uses NFC …

Read More »FortisPay Is Now Fortis, Signaling Its Stress on Payments Integration for Business Software

As trends such as payment facilitation and integrated payments continue to unfold, at least some payments providers are giving more thought to long-held branding strategies. The latest example is that of FortisPay, which on Tuesday announced it is dropping the “Pay” and is now in the market simply as Fortis. …

Read More »The Clearing House, SWIFT, And EBA Clearing Partner to Speed Cross-Border Payments

The Clearing House, EBA Clearing, a provider of pan-European payment-infrastructure technology, and financial-messaging specialist SWIFT have completed a proof-of-concept aimed at introducing faster cross-border payments than are currently available. The three member-owned companies announced Monday they have finished a project to synchronize cross-border payments occurring in one instant-payment system with …

Read More »Fiserv’s Clover Brings Cashless Payments to Major League Soccer’s Philadelphia Union

Subaru Park, home of major league soccer’s Philadelphia Union, is the latest sports stadium to go entirely cashless. The team announced Thursday it was deploying more than 130 Clover point-of-sale devices from Fiserv Inc. to enable contactless purchases at concession stands and premium seating areas in the stadium. Like many professional …

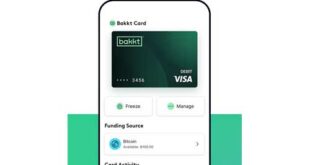

Read More »Bakkt Users Gain Access to Google Pay Crypto Purchases at Merchants Online And in Stores

Bakkt, a digital-asset marketplace, said its users can now load their Bakkt Visa debit cards into Google Pay and use the crypto-backed cards to make online and in-store payments where Google Pay is accepted. The consumer’s digital asset, such as Bitcoin, will be converted to fiat currency for these payments. …

Read More »How a U.K. Limit on Contactless Payments Could Drive Consumers to Mobile Wallets

An increase in the limit on what contactless cardholders in the United Kingdom can spend before they are required to authenticate themselves is raising questions about whether the new mandate will prompt consumers to shun their cards in favor of mobile wallets, which have no per transaction limit. The theory is …

Read More »