Citcon USA LLC is partnering with Klarna AB to add Klarna’s payment services to its mobile wallet for in-store and online purchases. The move expands to Citcon merchants Klarna’s Pay in 4 buy now, pay later loans, as well as Klarna Pay in 30 and other Klarna financing products. Consumers …

Read More »Search Results for: retail

Oracle Tweaks Contactless Acceptance And Other Digital Transactions News briefs from 1/12/23

Oracle Corp. launched its Retail Payment Cloud Service to support contactless payments for U.S. retailers at fixed-fee rate pricing. Mercatus Technologies Inc. debuted an updated version of its mobile grocery shopping app that includes seamless cart building and checkout, personalization, rewards and loyalty, and third-party delivery service integrations. MobileCoin Inc. launched Moby, a …

Read More »Checkout And Payments Now Play a Key Role in the Customer Experience, a Paysafe Study Finds

Checkout is gaining a higher profile in payments, and that’s influencing customer retention as well as a merchant’s ability to attract new customers, says a new study from Paysafe Ltd. That means modernizing checkout needs to be at the top of brick-and-mortar merchants’ to-do list in 2023, the study adds. …

Read More »Card Spending up 5.9% in 2022 And Other Digital Transactions News briefs from 1/11/23

Total card spending per household was up 5.9% year-over-year in 2022, according to new data from the Bank of America Institute. Kubra, which provides a payment network enabling consumers to pay bills with cash at retailers, said retailer Rite Aid joined its network, the 19th to do so. Blaze, a point-of-sale …

Read More »Markt POS’s Cloud Payments Service And Other Digital Transactions News briefs from 1/10/23

A technology company called Markt POS announced what it says is the first cloud-based software to handle payments and other functions exclusively for small and medium-size grocery and specialty stores. The company says more than 300 stores have signed up for the product. Iowa-based payments provider VizyPay said it has processed more than $4 …

Read More »Lured By Deep Discounts, Online Shoppers Set a Spending Record for the 2022 Holiday Shopping Season

E-commerce sales in the United States during the recently completed holiday shopping season—Nov. 1 through Dec. 31— totaled $211.7 billion, a 3.5% increase from the same period a year ago, according to Adobe Inc. The total set a record for holiday-season e-commerce sales, while the year-over-year increase was larger than …

Read More »How to Ride the Digital Wave

The digitally savvy consumer base is rising fast. Banks can surf that wave—or drown in it. Over the past 12 months, many bank clients have become much more at ease with digital interactions, which has resulted in decreased branch visits. What would happen to retail banks if they never returned? …

Read More »Meeting the SWIFT Challenge

Financial institutions that use the messaging network face a deadline for conversion to a new standard. Here’s one way to do that efficiently. SWIFT is used by banks around the world to securely send messages about money-transfer instructions. In fact, around $5 trillion a day passes through SWIFT’s messaging system. …

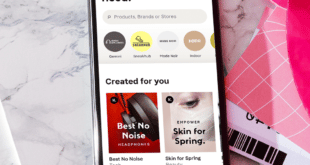

Read More »The Rise of Embedded Payments

With consumers expecting 21st-century digital experiences, the one-click capabilities of embedded payment are looking increasingly attractive to merchants and processors. When it comes time to pay, Uber customers don’t think twice. They open the Uber app, enter a tip for the driver, and click the pay button. It’s a seamless, …

Read More »The Self-Serve Future

Vending, as well as unattended payments, is evolving into a more-encompassing retail setting and bringing digital payments along. Few merchant segments have been as well-suited to contactless payments as vending and unattended payments. And now, spurred by changing consumer habits during the pandemic, contactless payments are driving cashless payments in …

Read More »