In the heart of America’s bustling commerce, a subtle yet powerful revolution is unfolding, driven by small merchants. The strategies of offering discounts for cash payments and imposing surcharges for card transactions are at the forefront of this change. These practices, rapidly gaining traction across communities, directly challenge the entrenched …

Read More »Search Results for: surcharge

Buying Groups Might—or Might Not—Give Merchants More Negotiating Power with the Card Networks

Card-acceptance costs and network rules weren’t the only subjects covered by the sweeping settlement revealed Tuesday involving Visa Inc., Mastercard Inc. and lawyers for the merchants that sued them. The pending agreement, which needs approval from a federal judge, allows for the creation of so-called merchant buying groups that would …

Read More »CFPB’s New Card Late Fees Cap and other Digital Transactions News briefs from 3/5/24

The Consumer Financial Protection Bureau finalized a rule that caps late fees on credit card payments to $8, down from a typical $32. The rule goes into effect 60 days following its publication in the Federal Register. Other provisions include ending automatic annual inflation adjustment on the fee and requiring larger card …

Read More »Payments 3.0: The Delicate Balance of Closed-Loop Cards

As banks and merchants fight over interchange regulation in Washington, the real struggle is in shoppers’ wallets, phones, and Web browsers. Last month, I wrote about how merchants use discounts, surcharges, and direct bank payments to influence consumer behavior. This month, we’ll look at another tool that merchants can use …

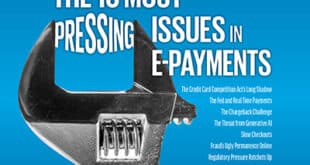

Read More »20 Years of Payments Coverage

Digital Transactions celebrates its 20th birthday with a review of the 10 major themes that continue to preoccupy the industry. When publishers start a magazine, whether in print or online—or both—there’s simply no way to tell how long it will last. There are too many unpredictable factors. But the publishers …

Read More »Payments 3.0: A Trend To Cash And Pay by Bank

The fight over interchange—and the future of payments—is moving to a new arena – the point of sale. Proposed rules on debit card interchange could become a sideshow to the main event that seems to be gearing up at cash registers and in remote payments. Two trends seem to be …

Read More »Acquirers and the CCCA

The Credit Card Competition Act, if it becomes law, will likely have unintended consequences for the businesses that sign up merchants for payment processing. Not all of them are good. Introduced more than a year ago, the Credit Card Competition Act has quickly become the hottest topic in the payments …

Read More »Acquirers Seek Answers from a Visa Surcharging Executive

More than 10 years after Visa Inc. wrote its rules permitting surcharging on its credit cards, questions remain among acquirers, especially those selling or considering surcharge programs for their merchants. Now, as more merchants mull surcharge or cash-discount programs to alleviate some of their card-acceptance costs, and with recent changes …

Read More »Acquirers Seek Answers from a Visa Surcharging Executive

More than 10 years after Visa Inc. wrote its rules permitting surcharging on its credit cards, questions remain among acquirers, especially those selling or considering surcharge programs for their merchants. Now, as more merchants mull surcharge or cash-discount programs to alleviate some of their card-acceptance costs, and with recent changes …

Read More »What’s an Acquirer To Do?

Agents that sell card acceptance aren’t powerless when merchants gripe about the cost. Merchant discontent over card-acceptance fees is nothing new, but every few years the din rises several octaves, just as it has in 2023. While merchants, card issuers, the card networks, and politicians argue over whether acceptance costs …

Read More »