Heading into the holiday shopping season, consumers are poised to make even more use of buy now, pay later options than in the past. Overall, 42% of consumers plan to use BNPL while holiday shopping, according to a survey by GoCardless, a provider of account-to-account payments. When Millennials were asked …

Read More »Search Results for: consumers

Consumers Embrace Digital Pay; ADS Teams Up With Sezzle; Nium’s New Crypto Service

A New Report Shows Just How Many Consumers Have Adopted Digital Payments Since Covid

It has been known anecdotally over the past year that the impact of the Covid-19 pandemic has shifted consumers to digital payments. On Monday, survey results emerged to show just how extensive that shift has been. Roughly one-third of consumers who now use such services as digital wallets, peer-to-peer payments, …

Read More »How Consumers’ Growing Adoption of BNPL Is Getting the Ad Dollars Flowing

The heady times for buy now, pay later just keep on rolling. Now, with 44% of consumers saying they have used BNPL options to make a purchase, according to personal-finance company Credit Karma LLC, providers of the point-of-sale financing have opened the ad-spending spigot. A new report from MediaRadar, a …

Read More »Consumers Are Flocking to E-Commerce, But They’re Hitting Too Many Brick Walls, Stripe Says

Despite consumers’ expectation that checkout during an e-commerce purchase should be fast and instinctive, most online merchants still have checkout procedures that add unnecessary friction, says a survey from online-payments powerhouse Stripe Inc. The report, released Tuesday, reveals that 96% of 200 North American e-commerce merchants surveyed had committed at …

Read More »How a U.K. Limit on Contactless Payments Could Drive Consumers to Mobile Wallets

An increase in the limit on what contactless cardholders in the United Kingdom can spend before they are required to authenticate themselves is raising questions about whether the new mandate will prompt consumers to shun their cards in favor of mobile wallets, which have no per transaction limit. The theory is …

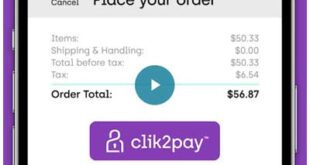

Read More »Startup Clik2pay Enables Consumers to Tap Their Bank Account For Online Purchases

Seeking to provide online merchants with a lower-cost payment option and consumers a better user experience, a 3-year-old, Toronto-based payment-service startup called Clik2pay is enabling Canadian consumers to pay for online purchases directly from their bank accounts at participating merchants. The new payment option, which launched Thursday, leverages the Interac …

Read More »BNPL Consumers Are Not Shy About Using Credit Products, a TransUnion Report Finds

New research suggests buy now, pay later users may not be shunning traditional retail credit products in favor of the installment-payment option. That’s one finding from TransUnion LLC’s “Understanding the Evolving Point-of-Sale” report released Thursday. The data show that 76% of the point-of-sale financing applicants had a retail card in …

Read More »Most Consumers Want To Decrease Credit Card Use As BNPL And Debit Gain Favor, a Survey Finds

A majority of U.S. consumers in all age groups—76%—would like to decrease their use of credit cards as they seek to avoid debt, are wary of their ability to pay off their balances each month, and have concerns about making the minimum payments, according to a survey from GoCardless Ltd., …

Read More »COMMENTARY: B2B Payments are Broken. Here’s What the Industry Can Learn from Consumers

The consumer-payments industry is thriving. Last year, consumers embraced more payment methods than ever, a behavior that companies like Stripe (now valued at $95 billion ahead of a highly anticipated Wall Street debut) are banking on in a post-Covid world. In fact, a recent Deloitte report tells us that, in …

Read More »