Early Warning Services LLC, operator of the Zelle peer-to-peer payments network, is celebrating a year just passed in which both dollar volume and transactions processed rose at double-digit rates. But the company also has its eye on promising markets like small businesses and on countering charges from U.S. Senators about …

Read More »Search Results for: scams

Zelle Posts Strong Increases in Volume And Financial Institution Membership

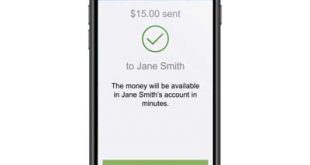

Zelle, the peer-to-peer payment network operated by Early Warning Services LLC, reported Thursday that consumers and businesses sent 2.3 billion in payments totaling $629 billion through the network in 2022. On a year-over-year basis, transaction volumes through Zelle increased 26%, and total transaction value increased 28%. Small businesses continue to be …

Read More »Data Breaches in 2022 Hit a Near Record High As Notices Increasingly Omit Information

Data breaches remained at near record levels in 2022, according to the Identity Theft Resource Center’s annual data breach report. The number of breaches totaled 1,802 last year, just 60 short of the all-time high recorded in 2021, making the total number of breaches in 2022 the second-highest on record. …

Read More »Working With Early Warning, Big Banks Eye a New Digital Wallet

A major venture by some of the country’s biggest banks to launch a digital wallet using a platform from Early Warning Services LLC, news of which emerged early Monday, is likely to benefit from the banks’ technology resources. But it could be hindered by consumers’ entrenched preferences for major-brand wallets …

Read More »Payments 3.0: With P2P Fraud, Focus on Before, Not After

The discussion about fraud in Zelle and other person-to-person payment apps focuses on the wrong question. Providers, industry observers, and regulators are all discussing what should happen when someone is scammed out of money on these apps. Recent conversations have revolved around whether or not banks, payments providers, or the …

Read More »Fraud on P2P Networks Hits 12% of Bank Customers in the U.S., J.D. Power Finds

Some 12% of U.S. customers have lost money to fraud on a peer-to-peer payment network, while 11% have seen it happen to a family member, according to survey results released earlier this month by J.D. Power. The networks cited by the respondents were Zelle, Venmo, and PayPal. For the survey, …

Read More »Study: Peer-to-Peer Payments Are Key To Financial Institutions’ Payment Strategies

As financial institutions look to revamp their payment strategies, peer-to-peer payments are expected to play a key role, says a report from Cornerstone Advisors. During the past three years, nearly 30% of community-based financial institutions have replaced their P2P service or selected a new one, and about one in five …

Read More »Zelle Users Are More Profitable for Financial Institutions, says an Early Warning Study

Customers new to using Zelle, the peer-to-peer payment network operated by Early Warning Services LLC, have higher levels of engagement with their financial institutions than customers not using Zelle. That’s according to a recent study conducted by Early Warning and Curinos, a provider of data and technology technologies to financial …

Read More »Wedge Joins Fiserv AppMarket And Other Digital Transactions News briefs from 12/19/22

Wedge Financial Inc. said its app, which lets users spend funds from multiple fiat accounts and assets using a single card, has joined Fiserv Inc.’s AppMarket. Work at the New York Fed under an initiative called “Project Cedar” means the United States has officially moved from the “research” phase to the …

Read More »Real-Time Payments Will Grow Nearly 300% Over the Next Five Years, Juniper Predicts

The growth of real-time payments over the next five years will gain momentum from cross-border transfers in a global economy, according to research released early Monday. Indeed, the total number of real-time transactions, also known as instant payments, worldwide will reach 376 billion in 2027, up 289% from 97 billion, …

Read More »