With the popularity of the buy now, pay later alternative growing, especially for online purchases, PayPal Holdings Inc. announced Tuesday it will no longer charge late fees for missed payments on its installment products in the United States, the United Kingdom, and France, effective Oct. 1. PayPal has already eliminated the fees in Germany and Australia.

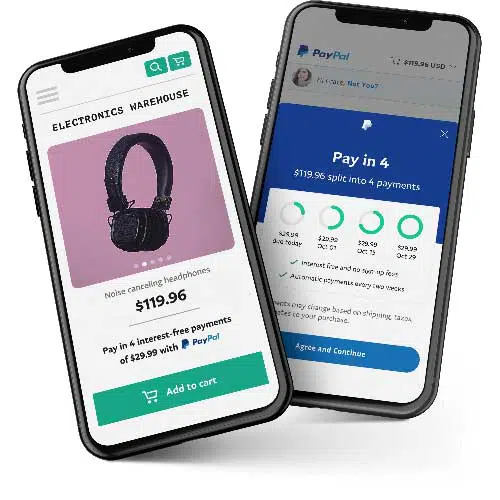

The payments giant says it is eliminating late fees as a way to enhance the value of its BNPL product, called Pay in 4. PayPal launched the service in October in what has become in recent years a hotly competitive market.

“Building on the success of our Pay in 4 launch in Australia without late fees, we know that eliminating late fees delivers an even better buy now, pay later experience that provides incredible value to our consumers and merchant partners,” Greg Lisiewski, vice president of global pay later products at PayPal, says in a statement.

Observers say consumers are embracing BNPL because it offers them a way to manage their finances by spreading out payments on a purchase. But many are gravitating to BNPL options that do not charge fees, PayPal argues. A recent PayPal study found that 33% of consumers say that no late fees is an important feature in choosing a BNPL service. In addition, 57% of Gen Z and Millennials feel BNPL is a smarter way to shop and 37% say it gives them more control of their finances.

Merchants offering Pay in 4 are seeing that a high percentage of consumers using the service are making repeat purchases, according to PayPal’s research. Specifically, these merchants see 50% of shoppers that use Pay in 4 are making a repeat purchase within three months, and 70% do so within six months. In addition, merchants are seeing higher conversion rates, PayPal says.

Luggage manufacturer Samsonite International SA, which began offering Pay in 4 last year, has seen a 25% lift in average order value when customers used Pay in 4, according to PayPal.

“Our customers have had the option to use PayPal Pay in 4 since October 2020, and we’ve seen an incredible response and adoption as our customers experienced different economic situations and wanted flexible payment options,” David Oksman, vice president of marketing and e-commerce for Samsonite, says in a prepared statement.

Since launching BNPL, PayPal has processed more than $3.5 billion on the service. In the second quarter of 2021 alone, PayPal processed more than $1.5 billion in BNPL transactions.