After what it calls a “comprehensive search process,” prepaid-payments and banking-services provider Green Dot Corp. has found a new chief executive to replace founder and long-time CEO Steven Streit. The Pasadena, Calif.-based company said Wednesday payments veteran Daniel Henry is taking over from interim CEO William Jacobs, who has served in that role since January, following Streit’s retirement.

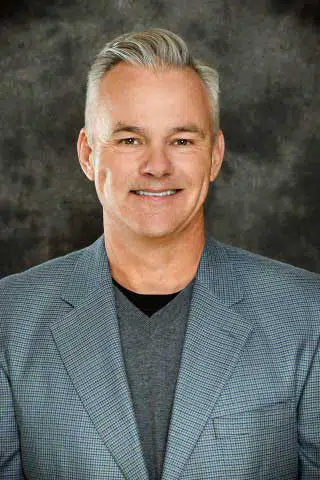

Henry, a co-founder of remittance-services provider Euronet Worldwide and long-time chief executive of prepaid-payments provider Netspend, takes over at Green Dot after a year in which the its stock plunged from a high of $83.09 as competition for the company’s core market—prepaid services for the largely unbanked—heated up. Its shares rose 16% at mid-morning Wednesday, to just over $24, following the company’s announcement of Henry’s appointment.

In recent years, Green Dot has expanded its market through its banking-as-a-service model, which relies on financial services for the underbanked through its Green Dot Bank subsidiary. To win more banking share from Millennial and Generation Z customers, Green Dot this summer launched its Unlimited banking service, which includes an account offering 3% cash back on online or in-app transactions, a debit card, and faster access to paycheck deposits. And in 2017, the company began supporting Apple Inc.’s Apple Pay Cash service with a prepaid card.

But a slowdown in year-over-year revenue growth last year, along with a drop in active accounts, disappointed investors.

In the wake of Green Dot’s share plunge, activist hedge fund Starboard Value LP last month bought a 9% share of the company. Starboard, which is known on Wall Street for pushing for change at what it sees as underperforming companies, issued a statement Wednesday lauding Henry’s appointment. “We believe that Green Dot is deeply undervalued and that there are a wide variety of opportunities that exist to unlock value,” the statement says. “We look forward to continuing our constructive dialogue with the company regarding operations, strategy, finance, and governance.”

Henry, who is also joining Green Dot’s board, ran Netspend for six years, negotiating its initial public offering in 2010 and its $1.4 billion all-cash sale, in 2013, to Total System Services Inc. (TSYS), now part of Global Payments Inc. Before that, he served as president and chief operations officer at Euronet, whose operations are largely located outside the United States, through 2006. For the past two years, Henry has served as chairman of prepaid-services company PaySign Inc.

“I see significant potential to build upon Green Dot’s solid foundation that combines its bank charter with its market-leading banking-as-a-service fintech platform,” Henry said in a statement.

In another personnel move, interim president J. Christopher Brewster will continue to serve Green Dot as a board member and chair of its audit committee. Upon the retirement of Streit, who founded Green Dot 20 years ago, the company said Streit would take on the role of chief innovation officer. A Green Dot spokesperson says that plan has not changed.