Credit union service organization PSCU/Co-op Solutions released its buy now, pay later service to credit unions, enabling their cardholders to make installment payments on their card-based purchases.

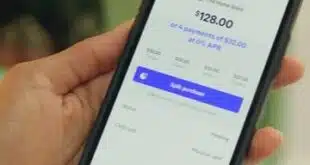

PSCU/Co-op, which merged Jan. 1, says cardholders whose credit unions enroll in the service can choose qualifying transactions to pay back in installments. Offers are presented via the credit union’s mobile app or online-banking portal. No application is needed to use the BNPL option, the company says.

For credit unions, one benefit stands out. “Cardholders tend to pay off term loans at faster rates than credit card balances. For credit unions, that behavior equates to lower chargeoff rates, reduced delinquency, and fewer balance transfers,” Nelson Fisher, PSCU/Co-op product development director, says in a statement.

Issuers can customize their BNPL options from fees and annual percentage rates to transaction limits and the duration of repayment windows.

Most of the back-end services for the program flow through Co-op-based tools, such as the reporting and analytics of BNPL use.

While it’s not the first BNPL option a service provider has made available to financial institutions, the latest offering from PSCU/Co-op comes as BNPL matures as a payment method, even as new uses continue to emerge.

“New and tenured competitors alike are standing up innovative business models to meet consumer demands for hyper-personalized financial experiences,” Fisher said. This creates a competitive lending environment for credit unions, which he says PSCU/Co-op’s BNPL service can address.