The concept of allowing consumers to use debit cards with PINs to make purchases on the Web took a big step forward on Wednesday with the Pulse electronic funds transfer network’s announcement that it is rolling out an online PIN-debit service. With some 4,400 member financial institutions, Houston-based Pulse, which has been testing the product since last summer (Digital Transactions News, March 23, 2009), represents by far the largest EFT system yet to make Internet PIN debit available to its entire card base.

The move also gives a significant boost to the provider of the technology, Atlanta-based Acculynk Inc., whose PaySecure software is in use at six EFT networks besides Pulse. “This is probably the most significant announcement in the history of the company,” says Ashish Bahl, Acculynk’s chief executive, about the Pulse development. “This is huge. We are now the standard for Internet PIN debit.” Bahl and other executives formed Acculynk in 2008 in the wake of the bankruptcy of Pay By Touch, which had owned the technology on which PaySecure is based.

Still, large gaps remain in Acculynk’s coverage. Among other top-5 PIN-debit networks, First Data Corp.’s Star and Visa Inc.’s Interlink are holdouts, and though Fidelity National Information Services’ NYCE has said it will support Acculynk, it has so far made no moves to introduce the PaySecure system. Widespread coverage by financial institutions and the cards they can bring into the system are critical to winning support from merchants and acquirers.

To that end, Pulse says its new service, which it calls Pulse Internet PIN Debit, will go live systemwide in October and will include all members, though individual institutions may opt out. Some may stay on the sidelines because their policies don’t support card-not-present PIN transactions, says Judith McGuire, senior vice president of product management at Pulse. Others may simply choose not to participate for other reasons.

But McGuire and Acculynk’s Bahl are optimistic that opt-outs will be a small minority. Helping to entice issuers is the fact that Pulse has set interchange pricing for Internet PIN debit at a “somewhat higher” level than point-of-sale interchange, says McGuire, though she refuses to be specific about rates. “We have had very positive feedback,” she says. “Issuers do feel this provides a very strong value proposition to them.” Bahl says he expects that close to all Pulse issuers will support the new service. Neither Pulse nor Accuynk will reveal the network’s card count, but industry estimates peg it at about 80 million.

Backers hope the inclusion of the majority of Pulse’s cards will attract merchants, avoiding the problem that typically afflicts new payment systems whereby consumers won’t use the system until more merchants accept it and merchants won’t accept it until more consumers use it. “There’s often a chicken-and-egg problem,’ says McGuire. “We’ve worked to help resolve that by bringing in a significant card base.”

Pulse argues consumer interest should be strong. In its pilot, some 54% of cardholders making online purchases opted to enter a PIN when they had a choice between PIN and signature debit. “There are incremental sales to be had with this product,” says McGuire. She won’t say how many cardholders participated in the pilot, but says the test generated “thousands” of transactions. Promotion of the new service, however, will be up to individual members. Pulse is providing product information for member Web sites, including a flash file demonstrating how it works.

Other results from the pilot indicated that chargebacks were 77% under the rate experienced with signature debit, while no fraudulent transactions occurred.

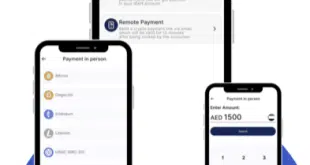

PaySecure works by presenting consumers on their PC screens with a so-called floating PIN pad that features a random arrangement of numerals. Cardholders use mouse clicks to enter their PINs on this virtual PIN pad, which rescrambles its numerical arrangement with each click. Acculynk formulates an encrypted PIN block for transmission to acquiring processors and ultimately to card issuers for authorization and settlement. As with in-store PIN debit, transactions are guaranteed to merchants.