To help large businesses reduce payment transaction costs and provide another option for how they receive payments, Square Inc. on Wednesday announced it will accept automated clearing house payments on Square Invoices.

The addition of ACH payments could also enable Square to attract large, complex businesses—such as wholesalers, home-repair specialists, and service providers—looking to reduce transaction costs, while giving those businesses another payment option that can speed up receipt of payment. The ACH feature follows Square’s introduction last week of inventory-management tools, another service likely to appeal to larger sellers.

While Square ACH payments can take three to five business days to process, more than 75% get paid within a day. Also, for many businesses, card-acceptance fees can be cost-prohibitive for large purchases. During the test period for the new service, Square found that the average ACH transaction on Square Invoices was $3,500. In addition, 28% of larger businesses are looking to accommodate a larger volume of transactions as sales increase, while 25% are looking to lower overhead, the company says.

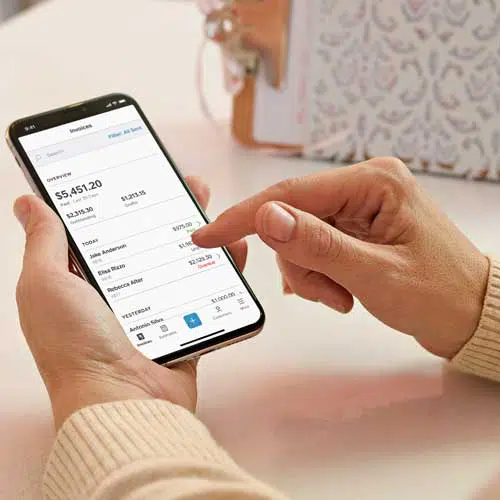

The 7-year-old Square Invoices service allows businesses to send digital invoices and track in real time which invoices have been paid or left unpaid. The service also sends reminders and accepts payments. Square launched a Square Invoices app in 2019.

“With ACH acceptance, businesses can benefit from seamlessly bringing all payments under one roof with Square compared to having a separate provider to process ACH transactions, enabling merchants to more easily keep track of payments,” Ashley Grech, global head of sales, says by email. “Businesses with large ticket sizes have been looking for ACH payment acceptance in order to unlock low transaction fees and also streamline manual processes of dealing with paper checks and cash, helping them save valuable time and be more efficient.”

Businesses that send invoices on a recurring basis can use Bank on File with ACH payments to automatically bill a customer by collecting and saving their bank information, and bill them on a recurring basis. Indeed, 24% of merchants surveyed cited administrative tasks such as billing and payment processing as key pain points in running their business.

Square Invoices is free for Square sellers. ACH transactions have a processing fee of 1%, with no fees for failed transactions. More than $20 billion in dollar volume has been paid through Square invoices on more than 100 million invoices sent.