The Internal Revenue Service will begin requiring peer-to-peer payment apps in 2025 to issue 1099-K statements to self-employed workers who received more than $5,000 in payments through those apps in 2024.

The new requirement, which is being implemented after a two-year delay, applies to such P2P apps as PayPal, Venmo, and Block inc.’s Cash App. It also lowers the IRS’s reporting threshold for self-employed workers being paid through P2P systems from $20,000 or more over 200 transactions.

The new requirement is reportedly intended to help the IRS keep better track of the income earned by self-employed workers that might otherwise go unreported.

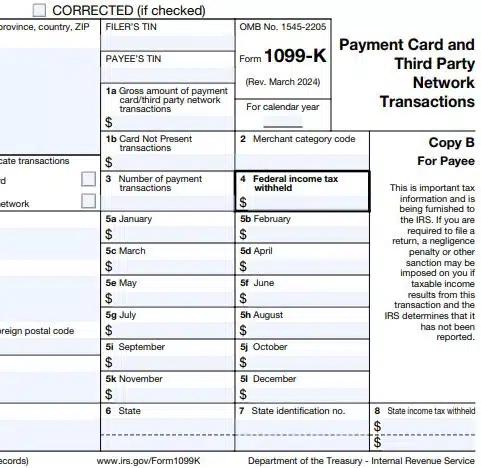

1099-Ks are issued when a self-employed worker receives payment via credit, debit, or stored value card or a third-party payment app or online marketplace, according to the IRS Web site. Organizations sending out 1099-Ks are required to send copies to the IRS.

Although the new requirement is in place for payment apps, the IRS is reportedly reminding self-employed workers they must declare all income whether they receive a 1099-K statement or not.

The new reporting requirement does not apply to Zelle, the P2P network operated by Early Warning Services LLC, according to the company’s site. In recent years, Zelle has been riding a growth wave of consumer payments to small business. During 2023, for example, payments to small business through Zelle totaled more than $100 billion, up 39% from a year earlier.