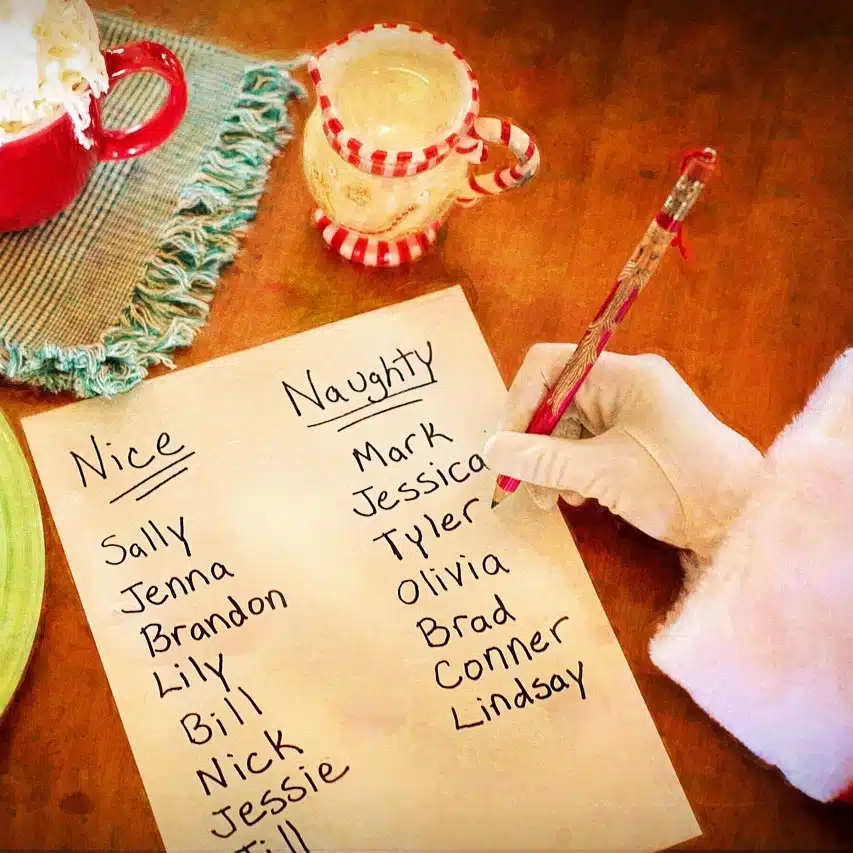

Some consumers better hope Santa Claus doesn’t read the latest fraud report from Socure, a fraud-prevention and authentication provider. It found 13% of U.S. consumers committed first-party fraud during the 2024 holiday-shopping season.

Often called friendly fraud, first-party fraud occurs when a consumer exploits return and refund policies for financial gain.

Incline Village, Nev.-based Socure says this can take the form of disputing legitimate credit and debit card transactions, falsely claiming a delivery was lost or stolen, or making a credit card or buy now, pay later purchase with no intention of paying it back. This type of fraud comes at a more than $100 billion annual cost to merchants, Socure says, including $89 billion from chargebacks, promotional abuse, and return fraud, and $18 billion in credit card fraud losses.

Why do consumers knowingly do this? Socure data, from its latest Socure Risk Insights Report, found that 60% of perpetrators cited financial struggles as the primary reason and 90% cited financial pressures during the holidays.

“Consumers tend to spend more during the holidays as a force of habit, likely due to peer pressure (‘everyone else is going on a shopping spree, why shouldn’t I?’), or because they were once able to afford these things but their circumstances have changed,” Ori Snir, Socure head of product managements, fraud and identity solutions, says in an email to Digital Transactions News. “After overspending, it’s possible they realized that they spent more than they can or just decided to spin the roulette [wheel] to see if they can get their money back.”

As with many instances of fraud, the rationale that first-party fraud causes no harm may assuage concerns over committing it. Thirty-nine percent of the 2,000 consumers surveyed by Socure in early December believed it causes no harm and a majority—63%—agreed that large retailers can afford to cover the cost of disputed legitimate charges. A full 25% of those engaging in first-party fraud have no regret.

One popular first-party fraud tactic is fake “porch pirate” incidents, where consumers claim packages left at their doors by delivery services are stolen by another individual. During the holiday season, that rate jumps to 25% compared with its 8% rate during the non-holiday season.

Socure’s research also reveals that the banking and credit segments are affected the most, with 9% of its transactions during the holidays disputed and 11% yielding unpaid credit card bills. Within e-commerce, 11% of respondents admitted to first-party fraud, and a range of 8% to 10% using buy now, pay later services admitted their actions.

One way to counter this activity is with technologies that use artificial intelligence and real-time data sharing, Socure says, so businesses “can address the root causes of fraud—from purchase regret to financial hardship—while safeguarding their revenues.”

As Snir, says, “Fight back! Step up verification on risky transactions to selfie or document verification—gain evidence that the consumers themselves are making the purchase by collecting further information and use that to deny claims or chargebacks. Doing so will help to prove that these purchases are legitimate.”