Value-added resellers and independent software vendors enticed by the attractiveness of surcharging and cash-discount programs find there’s no one-size-fits-all approach for enrolling merchants. Questions about the programs abound at RetailNow 2024, the annual conference sponsored by the Retail Solutions Providers Association and in progress this week in Las Vegas.

The most prominent questions are, what are these terms and how are they different. Surcharging enables merchants to add a fee, which is typically the lesser of the cap allowed by card brands or a limit set by states in some cases, to help recoup their credit card processing costs. Cash discount programs, sometimes known as dual pricing, offer consumers a less expensive price when paying by cash or debit card, which are prohibited from being surcharged.

Which one to offer to merchants and how to do so in a compliant way are questions that are often best decided based on the reseller’s services and its merchants. “Everything is nuanced,” says Jill Miller, RSPA legal counsel and an attorney at Bodman PLC, a Detroit-based law firm.

Putting a program in place starts with merchant education, says Ekta Iyer, cofounder and chief executive of Alliance Bancard Systems Inc. The four elements of a compliant program, she says, begin with including signage disclosing the use of surcharging or dual pricing on the door to the merchant’s store, on the count, and on its Web site.

“The second part is the actual dual pricing,” Iyer says. Debit and cash are discounted. The regular price is for credit cards, she says. Helping the merchants properly display the pricing can be as simple as informing them that it must be disclosed. They can take care of printing new menus or applying remedies to their existing menus. Or it can involve supplying them with the updated pricing tags. Iyer says Alliance may provide dual-pricing stickers for menus at restaurant clients.

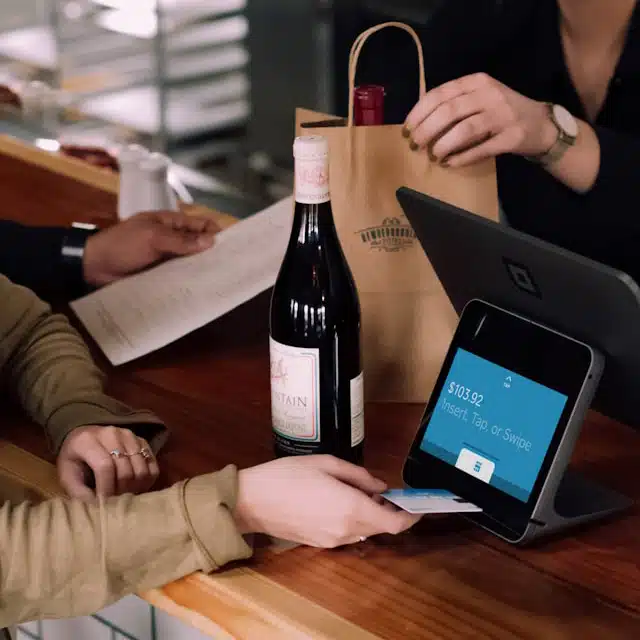

Another component is helping the merchant understand the importance of training its staff to inform consumers of the dual-pricing options, she says. That verbal notification can help alleviate potential pushback and keep the transaction trouble fee. The fourth component is having a point-of-sale service in place that provides a compliant program that can distinguish a credit card from a debit card to ensure the proper price is assigned to a transaction.

Attendees were concerned about how dual pricing might work in a card-not-present situation, since e-commerce PIN-debit transactions are rare and most debit card transactions are processed as signature debit. This doesn’t matter, Iyer says, if the bank identification number, known as the BIN, indicates the card is a debit card. Then it is exempt from surcharging and should receive the cash price in a dual-price situation, regardless of whether it’s a card-present or card-not-present transaction.