The Securities and Exchange Commission filed a civil lawsuit Tuesday accusing former Heartland Payment Systems Inc. chief executive Robert O. Carr and his girlfriend, Katherine M. Hanratty, with insider trading in connection with Heartland’s sale to Global Payments Inc. in April 2016.

The lawsuit pending in U.S. District Court in Bridgeport, Conn., is similar to one Heartland filed against Carr and Hanratty in late May in federal court in Trenton, N.J. Carr called that case, in which Heartland alleges breach of fiduciary duty, a “smear campaign.”

Proceedings in the New Jersey case have been put on hold until no later than Sept. 6. A magistrate judge’s order granting the extension indicates without giving details that the United States attorney’s office also is investigating the matter.

Carr’s lawyer, Michael G. McGovern of Ropes & Gray LLP in New York, tells Digital Transactions News by email that “although not included in the SEC’s complaint, we have brought to the government’s attention exculpatory information regarding the legal advice Mr. Carr received directly from Heartland’s general counsel at the time these events were occurring. We are continuing to discuss this matter with the SEC, and we remain confident that this matter will be resolved favorably.”

A lawyer for Hanratty, who lives in Watertown, Conn., did not respond to a Digital Transactions News email requesting comment.

The SEC is seeking disgorgement of the $250,000 profit Hanratty made based on alleged improper tips from Carr, along with interest and penalties. The commission also seeks to bar Carr from serving as an officer or director of any SEC-reporting company.

According to the lawsuit, Atlanta-based Global’s CEO (not identified by name, but Jeffrey S. Sloan was at the time and remains Global’s chief executive) approached Carr at an October 2015 conference “to discuss Global’s potential acquisition of Heartland.”

The complaint then cites emails between Carr and Hanratty purportedly showing that Carr kept her informed about his talks with Global weeks ahead of the Dec. 15, 2015, public announcement that Global Payments planned to acquire Princeton, N.J.-based Heartland for $4.3 billion. In mid-November, Carr allegedly gave her a personal check for $1 million, with “loan” written on the check’s memo line. Hanratty deposited the money at her local bank, then used $900,000 of it to open a brokerage account. In the account-opening paperwork, she said the funds were a gift, and she named Carr as the beneficiary of the account in the event of her death, the SEC says.

Then she bought 11,393 shares of Heartland in three trades between Nov. 18 and Nov. 23, all the while keeping Carr informed of her activities, according to the suit. “In communications with her broker while opening the brokerage account, Hanratty stated that she felt obligated to purchase Heartland stock because she received the gifted money from the owner of the company,” the complaint says.

Heartland’s stock rose 11% immediately after the merger announcement. Hanratty held on to the shares for nearly five months. On April 11, 2016, she emailed Carr asking when she should sell, according to the suit. Since the share price had risen further, he replied that he saw “no reason at all” that she shouldn’t sell that day. She told him the next day that she had, generating a $250,628 gain, the SEC alleges.

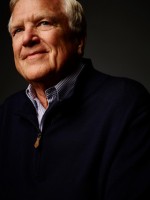

The suit says Carr, 73, of New London, N.H., in 2011 became “romantically involved” with Hanratty, 65, who co-owns a Connecticut staffing agency. They traveled together frequently to visit family and friends, and sometimes she even accompanied him on business trips.

“Over time, Hanratty repeatedly expressed concern to Carr regarding her financial security,” the suit says. “In March of 2015, while on vacation together in Mexico, Carr offered to give Hanratty some money for her financial security. Hanratty rejected Carr’s offer at the time, but it remained a topic of conversation between them at least through the end of 2015.”

On Nov. 23 of that year, after receiving Carr’s check, Hanratty allegedly emailed him “to express her gratitude and stated ‘for the first time ever I feel a sense of relief knowing that I have some security,’” the lawsuit says.