Zelle, the peer-to-peer payments service from Early Warning Services LLC, took steps late Thursday to clear up misperceptions concerning its decision to limit the capabilities of the Zelle standalone app.

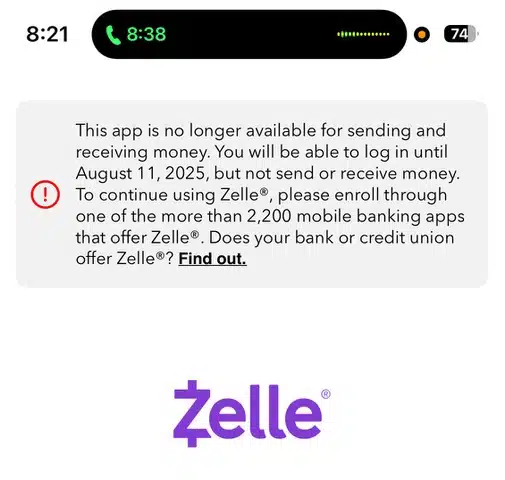

As of April 1, app users can no longer transact or enroll in Zelle. Instead, the app will become more of an information tool for users, who will be able to check their statements through August and receive information about avoiding scams and fraud going forward. Zelle informed app users of the changes in a blog post last October and through in-app messages.

The move was prompted primarily by low transaction volume through the app. About 2% of total transactions were conducted through the app, which can be downloaded through an app store, the network says. Zelle adds that transaction volume through the app has always represented a “small share of total transactions.”

Zelle rolled out the app when the P2P service launched in 2017 to service consumers whose financial institutions had not joined the network. At the time of its launch, Zelle had 30 financial institutions on the network. The app made it possible for two consumers whose financial institutions were not on the network to send and receive funds through Zelle. The number of financial institutions on Zelle has since swelled to 2,200, making it easy for consumers to use the P2P service through a financial institution’s Web site or mobile app. As a result, the network says it no longer sees a need to maintain a separate app for transactions.

“Zelle is not going anywhere,” a Zelle spokesperson says by email. “It is still available through more than 2,200 banks and credit unions. This change is only related to the seldom-used standalone app consumers downloaded from their app stores and is something we’ve communicated about with app users since October 2024. Zelle is so widely available at U.S. financial institutions, and the standalone app saw so little use relatively, that we decided to make this change.”

Zelle users’ preference for financial institutions’ Web sites or apps is not surprising given that Zelle is a “bank-driven initiative,” unlike PayPal’s Venmo or Block Inc.’s CashApp, Ariana-Michele Moore, strategic advisor, retail banking and payments at Datos Insights, says by email. “Eliminating the separate Zelle app simplifies the offering and drives the emphasis on in-app/on-site usage,” Moore says. “This move is also consistent with how Paze is offered.” Paze is the online checkout service from Early Warning.

So far, the changes to the standalone app have been well received by consumers, as Zelle says it has seen virtually no consumer complaints on social media about the move. In communications channels where there has been “some confusion” about the move, people are encouraging standalone app users to use Zelle through a participating bank, the network says.

In February, Zelle announced dollar volume sent over the network in 2024 totaled a record $1 trillion, up 27% from a year earlier. A few weeks later, the Consumer Financial Protection Bureau dropped its case against the network and three of its bank owners (Bank of America, JPMorgan Chase and Wells Fargo) for what the agency claimed were failings by the defendants to protect consumers from fraud.

In response to the allegations, Zelle points out that more than 99.9% of payments over the network have had no reports of fraud or scams since its launch.