Diners visiting a Tim Hortons restaurant in Canada and the United States now have a new way to pay for their meals and coffee. The restaurant chain, which has more than 3,600 Canadian locations and 870 in the United States, has added a mobile-payments function to its smart-phone app.

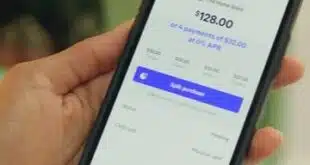

Consumers set up an account in the TimmyMe app and use a prepaid Tim Card to fund it. Consumers can fund the Tim Card in a Tim Hortons or online using a MasterCard Inc. or Visa Inc.-branded payment card.

To make a payment with the app, which is available for smart phones using Apple Inc.’s iOS, Google Inc.’s Android, and BlackBerry 10 operating systems, the consumer logs into his Tim Card account and tells the cashier he is paying with it. Upon the go-ahead from the cashier, the consumer selects Tap to Pay in the app, which generates a bar code to hold beneath a bar-code reader. Once the bar code is scanned, the funds are deducted from the Tim Card.

Consumers also can use near-field communication (NFC) technology in compatible BlackBerry devices to make a mobile payment, but not with NFC-equipped Android devices. Tim Hortons says that capability will be coming soon for devices using Android 4.4 and above. The app also includes a store locator and nutritional information functions.

In a press release, Tim Hortons says the free app is meant to enhance service and customer convenience. “The introduction of scan-to-pay technology on our TimmyMe app provides our guests with an easy, secure and convenient way to pay, and gives them more time to enjoy their favorite Tim Hortons products, a spokeswoman tells Digital Transactions News.

n

The app, which encrypts personal information stored in the app, has been tested in locations in the Niagara region in Canada, and in Maine, Michigan, New York, and Ohio since December, the spokeswoman says.

Tim Hortons may be hoping to replicate some of the success of other closed-loop, prepaid mobile-payments programs like those from Starbucks Corp. and Dunkin’ Donuts, suggests George Peabody, an analyst at the Menlo Park, Calif.-based Glenbrook Partners consulting firm.

More than 10 million Starbucks customers actively use its mobile app, twice the number from a year ago, Howard Schultz, Starbucks chairman, president and chief executive, told analysts during a recent earnings call. “Mobile payments now account for over 14% of tender in our company-operating stores in the U.S. and Canada, rising 75% from just a year ago,” Schultz said.

“It sounds like Tim Hortons has looked at the success that Starbucks has enjoyed and are [looking] to see if they can replicate the success,” Peabody tells Digital Transactions News. Built-in loyalty functions will aid the app’s adoption by consumers, he adds.

Consumers are willing to install apps like Tim Hortons and Starbucks on their smart phones because of the benefits, Peabody says, such as the ability to earn and track loyalty points and redeem these points.

Merchants, too, benefit from potentially generating new customers as well as furthering relationships with existing customers, according to Peabody. Merchants also benefit by gaining access to consumer purchasing behavior, he adds.