A fresh report from Consumer Reports finds that two of the four peer-to-peer payments companies it evaluated have cleared up the definition of “unauthorized” transactions pertaining to fraud. The publication last reviewed Apple Cash, Cash App, Venmo, and Zelle in 2022.

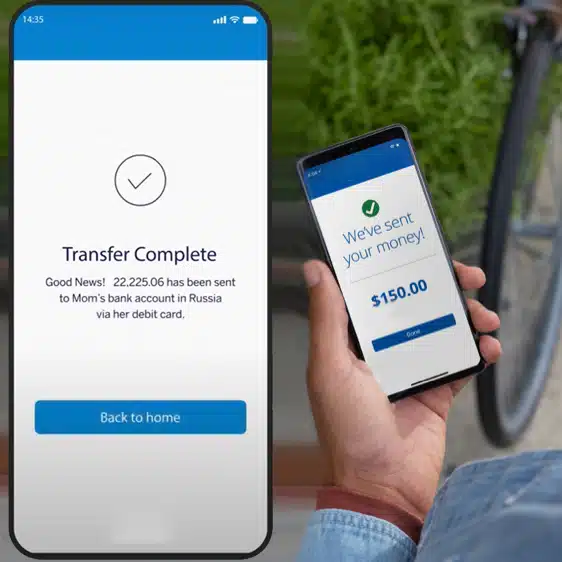

The issue of what is an unauthorized P2P transaction gained more visibility as customers who had been induced to send funds to fraudsters turned to their P2P providers and banks for assistance. Because many consumers made these transactions willingly, though false pretenses, they often were left with a financial loss.

Apple Cash, since 2022 notes that “Payments that you are induced to make by an imposter or by other fraud are not “unauthorized“.” Venmo, the social P2P payments service from PayPal Holdings Inc., removed a statement that allowed users 60 days to report fraud and be eligible for “100% protection for unauthorized transactions.” Consumer Reports noted a similar statement was in the July 2, 2024, Venmo user agreement, but it could not be found in the Sept. 11, 2024, version. Cash App and Zelle, the P2P payment service from Early Warning Services LLC, have made no policy changes since 2022, Consumer Reports says.

Zelle, which is offered as a standalone app or within a bank partner’s app, has adapted its program with a campaign to educate consumers how to spot and avoid financial scams and in late 2023 some of its banks issued refunds to fraud victims. Zelle and other P2P payments firms faced legislator scrutiny a couple of years ago over fraud on their networks.

Consumer Reports also examined whether the platform’s policies are clear that scams do not qualify as unauthorized transactions. Its review found that Apple Cash is the sole entity with a clear definition, while the others have what it calls vague explanations.

As might be expected from Consumer Reports, it concludes in its 2024 review that more protections are needed. “Despite the increasing risk and harm of fraud and scams on P2P services, companies have made no pro-consumer changes to their policies,” it says. It suggests the Consumer Financial Protection Bureau update Reg E, the Electronic Funds Transfer Act, to require more generous liability protection for unauthorized transactions.