U.S. Bank is stepping up its efforts to entice merchants to use its business checking account with the ability to accept credit and debit card payments.

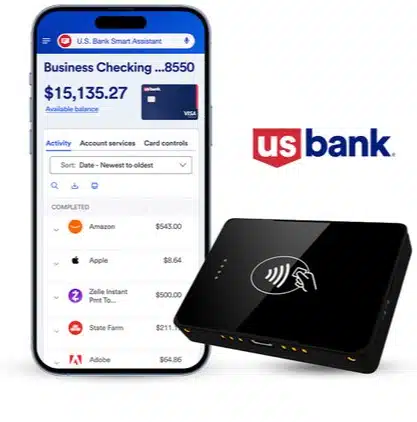

Announced Monday, the U.S. Bank Business Essentials account enables merchants to accept card payments and be eligible for free same-day access to their funds and receive a no-cost mobile reader. The bank says sales are processed daily and deposited into the associated checking account, though funding speeds will vary between weekdays and weekends and are dependent on batch settlement times, though batches are processed each day, including Saturday and Sunday.

The card reader is an Ingenico Moby/5500 device that can vary in price, but lists on technology supplier CDW’s Web site at $151.99. Account holders also are issued a U.S. Bank Business debit card.

Targeted at small businesses, the new checking account and acceptance service also includes fraud-prevention services and a single application for merchant onboarding. A U.S. Bank survey last year found that 80% of respondents prefer working with companies that provide bundled banking, payments, and business-operation services.

“By enabling small business owners to manage their cash flow in one place—with no monthly maintenance fee—we are helping our clients save time and money, lessening their operational burden, and giving them access to improved business insights,” Shruti Patel, U.S. Bank chief product officer for the business banking segment, says in a statement.

In other U.S. Bank news, the Minneapolis-based financial institution released Spend Management, a platform for businesses to monitor, track, and control their card-based spending.

Available to businesses with a U.S. Bank business credit card, the service can enable them to set spending controls for cards, switch cards on or off, and assign cards to specific employees, job sites, or departments, though some features may require a fee.

Spend Management also can be used to adjust spending-limit requests as needed and enables users to upload receipts to automatically match transactions.

A free version of the platform is available to U.S. Bank business card holders, while a paid version—$79 a month or $799 annually—includes the department designations, bulk user management, custom rules for categorizing and splitting transactions, and the ability to create approval requests and expense-policy settings.