A test this past September of a real-time pay by bank payments option inside the Walmart app indicates the service is on track for a broader debut in 2025, Digital Transactions News has learned.

Speaking at the Nacha Smarter Faster Payments 2025 conference in New Orleans, Sarah Arnio, Walmart Inc. director of digital payments, tells Digital Transactions News the project is current.

“We are on track to offer instant payments later this year,” Arnio added during a panel.

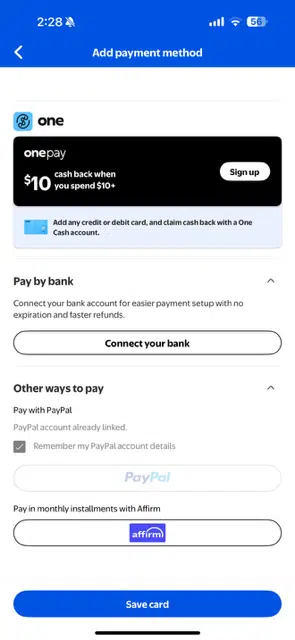

Running on the Fiserv Inc. NOW network, the September transaction was a proof of concept for a real-time payment transaction using a consumer bank account as the funding source. Walmart already offers pay-by-bank transactions on its Web site and in app, having launched that earlier in 2024. That service process payments via the automated clearing house system.

The real-time aspect means funds are debited instantly from the shopper’s bank account and credited just as quickly to Walmart. Eventually, the real-time payments services from the Federal Reserve’s FedNow service and The Clearing House Payments Co. LLC’s RTP network could be incorporated, but not any time soon, Arnio says.

The merchant incentive for pay by bank, especially at Walmart, is the potential to bypass credit and debit card interchange fees while further cementing connections to Walmart shoppers. When shopping at Walmart, most consumers use a debit card, Arnio said.

Persuading consumers to change their payments behavior can be a daunting challenge. Widespread contactless-payments adoption, for example, didn’t happen until the onset of the Covid pandemic, though contactless cards had been available since the mid-2000s. And Walmart may experiment with different rewards or incentives for its pay-by-bank option, Arnio said. “We’re not there yet,” she cautioned. More testing is needed, she added.

The primary pay-by-bank convert likely is not the consumer who prefers to shop with a credit card, Arnio says, adding, “a customer using a credit card is harder to shift to pay by bank.”

Walmart also is evaluating the dispute process for pay-by-bank transactions, something the card networks—American Express, Discover, Mastercard, and Visa—have refined for credit and debit card transactions. Pay by bank is a new option, at least in a retail environment, so dispute processes are in development.

Despite many retailers’ best efforts, products may be damaged or the wrong size when shipped, for example. “There needs to be recourse or options for customers to get their money back,” Arnio says, referencing this matter as one of the tipping points to broader pay-by-bank adoption overall.

E-commerce is one of three use cases for pay by bank. The other two are account-to-account payments and billing and recurring payments.

“We know there’s a percentage [of customers] that want to pay directly with a bank account,” Joshua Karoly, director of payments product at Netflix, said during another session. Why that is may be personal preference, debt concerns with credit cards, or other issues, he says.

From his perspective, Karoly is not looking at pay by bank to cannibalize credit or debit card transactions. “I’m really looking to for this population that wants to pay with a bank account to enable them to pay with a bank account,” Karoly said.

The probelm with pay by bank for Netflix is that it’s not instant, he said. “The fact that it’s not instant makes it really hard for me to deliver an instant good to somebody when I don’t instantly know that the funds are going to be available.”