Some 12,000 restaurants in 100 countries already use Toronto-based TouchBistro Inc.’s iPad-based point-of-sale software, but a new agreement with JPMorgan Chase & Co.’s WePay subsidiary could put TouchBistro in touch with many more U.S. eateries.

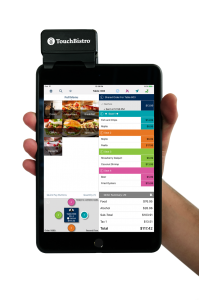

TouchBistro and Chase on Tuesday unveiled TouchBistro Payments Powered by WePay, which will launch this spring. The service includes a detachable card reader that enables restaurants to accept at the table chip and magnetic-stripe credit and debit card payments, as well as contactless payments through cards or mobile wallets. The service will be available only in the U.S., at least for the time being.

TouchBistro, which claims C$6 billion ($4.65 billion) in annualized payment volume, already has agreements with six payment processors. Besides JPMorgan Chase they include Moneris, Cayan, iZettle, PayPal, and Premier Payments. Users of the new service must take processing services through Chase, which will be available as soon as they get their iPad and card reader.

“With TouchBistro Payments powered by WePay, our restaurants will onboard instantly, so they can start taking payments the moment they unbox TouchBistro,” Alex Barrotti, TouchBistro’s founder and chief executive, said in a news release. “Both restaurant owners and customers will experience easier payment processing with the new, mobile, EMV-compliant payment device for digital, credit, and debit card transactions.”

The TouchBistro partnership is the second major deal for WePay since JPMorgan Chase bought the Redwood City, Calif.-based firm in December. WePay, now a part of Chase’s merchant unit, develops payments-related application programming interfaces (APIs) for software developers to put into their own programs. The company also is a payment facilitator that enables small businesses without their own merchant accounts to submit card transactions for authorization and settlement. Among its 1,000-plus partners are event-management firms such as SignUpGenius, fund-raising platform GoFundMe, and email services provider ConstantContact. Shortly after the acquisition, e-commerce platform provider Volusion LLC said it would make WePay the backbone of its new payment service.

For TouchBistro, the WePay partnership potentially means much more exposure to prospective U.S. restaurant clients. “Through the WePay relationship, TouchBistro will gain a promotional platform to market its restaurant point-of-sale solution on Chase.com and other channels,” the release says. “Chase has more than 5,000 branches and four million small-business clients, including thousands of restaurants, breweries, and others in the food-service industry.”

TouchBistro gets a share of the payments revenues, but generates most of its income from monthly subscriptions for its restaurant-management software-as-a-service platform.