The impending arrival of a commercial real-time payments service from no less an entity than the Federal Reserve will be a major event, but one Mastercard Inc.’s top brass says the card company will take in stride. “We’ll have to wait and see how it plays out, we’re well-positioned,” Michael Miebach, Mastercard’s chief executive, told equity analysts early Thursday.

Miebach conceded Mastercard has been eyeing developments surrounding FedNow, the Fed’s real-time service scheduled to launch in July. “We’ve been watching closely,” he said, cautioning that payment flows the new system could target include account-to-account transfers between consumers and businesses.

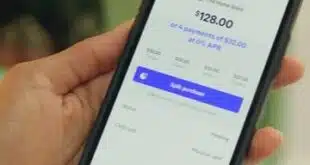

Overall, “for the consumer, [FedNow] has to be an easy experience, and the card systems have demonstrated that,” he argued. Mastercard offers real-time transfers between cards with its Mastercard Send service, launched in 2015. Visa Inc. offers a competing product called Visa Direct.

Miebach warned the analysts, however, that a full-bore “go-live” launch can differ in major ways from the experience of a testing phase, which FedNow has been in. The Fed first proposed building a real-time payments network in 2019.

Mastercard is also leveraging generative AI, another big topic in the news lately with the emergence of ChatGPT, Miebach added. “We’ve been using AI for the better part of the past decade,” he told the analysts. “You’ll find it embedded in a whole range of our products.” That technology now includes generative AI, he added. “We’re actively engaged on that, [but] the application needs to be done in a principled way. It’s something we can’t afford to ignore, so we’ll scale up.”

ChatGPT, an advanced version of artificial intelligence, generated news as some observers feared the sophisticated technology could more easily dupe targets into thinking they are dealing with another human being.

Overall, Miebach took care to present an optimistic projection for Mastercard, based on its first-quarter performance. “Consumer spending has remained remarkably resilient. The consumer continues to access credit,” he said. On the acceptance side of the business, Mastercard during the quarter surpassed 100 million locations worldwide, a number that has doubled over the past five years, Miebach said.

He added more than 70 regional markets globally have introduced a tap-to-pay capability, a technology that allows merchants to accept card transactions with nothing more than a mobile phone. More than 100 markets are processing at least half of their transactions via contactless technology, Miebach reported.

Headwinds for the business include higher interest rates and a crisis stemming from the stunning failures during the quarter of such major banks as Silicon Valley Bank, Signature Bank, and Silvergate Capital, said chief financial officer Sachin Mehra. Miebach, however, quickly added that “flexibility and agility is critical, so we feel ready for all that.”

For the quarter, Mastercard reported $673 billion in gross dollar volume, up nearly 9% year-over-year. Credit card volume, at $343 billion, was up 15%, while the $331 billion in debit volume rose 3.4%. Worldwide, credit and debit/prepaid volume was $2.1 trillion, a nearly 10% increase.

Switched transactions totaled 32.5 billion for the quarter, up 12%. Cards worldwide, both Mastercard and Maestro, came to 3.16 million, a nearly 9% increase.

Revenue for the quarter was $5.75 billion, rising 11.2% from the same quarter in 2022.