Facebook Inc. has said it will turn over control of its Libra cryptocurrency initiative to a consortium of companies that will constitute the Libra Association. But one related property the massive social network will retain, albeit as an arm’s-length subsidiary, is its new Calibra unit, which will run Facebook’s own Libra-based apps when it begins operations next year.

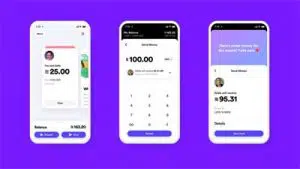

Since Calibra will be integrated with Facebook properties like Messenger and WhatsApp, it could overnight become a dominant mobile wallet in a market long dominated by products like Apple Pay, Google Pay, and retailer apps. And next year, Calibra is expected to launch a standalone wallet.

“With their scale and customer base, it’s impossible to ignore Facebook’s efforts in payments,” says Thad Peterson, a senior analyst at Aite Group, a Boston-based consultancy. “The question is whether or not Calibra will be the best way for them to get to scale in the space.”

The potential for Calibra lies in the user base offered by its various properties. Facebook as a whole claims 2.4 billion users, while the estimates for Instagram, Messenger, and WhatsApp are 1 billion, 1.5 billion, and 1.3 billion, respectively. Even allowing for considerable overlap, numbers like these are already drawing considerable attention among many who followed last week’s official unveiling of Libra.

Libra itself could prove to be advantageous for Calibra, as well. The digital currency is designed to run on a distributed ledger capable of handling around 1,000 transactions per second. While that’s well under the capacity of Visa Inc. (more than 65,000 transactions per second as of 2017), it’s a huge improvement on Bitcoin, whose rate of seven transactions per second has discouraged merchant acceptance. “If Libra is basically a money-movement engine, designed to help Facebook users purchase stuff or transfer funds to friends, then it looks a lot more like PayPal than it does Bitcoin,” notes Peterson.

But observers are quick to point out that Facebook’s record in payments has been mixed, at best. In 2015, for example, the company enabled nationwide capability for a peer-to-peer payments app on Messenger that has drawn little notice, despite wider capabilities introduced since then (besides Messenger, WhatsApp has been testing a payments app in India).

“The unfortunate fact is that Facebook already has a wallet integrated into their Messenger app, and you can use it for P2P, as well as to buy things on Facebook Marketplaces, donate money, buy games, and pay for ads,” says Aaron McPherson, vice president for research operations at Mercator Advisory Group. “I haven’t seen any numbers on that, which usually means they aren’t very good. I don’t see why Calibra would succeed where the existing wallet hasn’t.”

Also, observers question how deeply Facebook will be willing to reach into its promotional budget to push Calibra in a market with rival products from resourceful companies. “Most of the growth is in merchant-sponsored wallets, due to rewards,” says McPherson. “Calibra would have to address that issue to gain widespread adoption, and there are many well-established alternatives.”

Big user numbers like those boasted by Facebook may not guarantee success, particularly for a wallet that deals in a new currency many consumers are likely to associate with Bitcoin and its travails. But Libra is designed to be less volatile than cryptocurrencies like Bitcoin, and that coupled with its processing speed and favorable transaction costs might attract merchants. The question is whether those advantages will be enough.

Even those disposed to see some advantages in Calibra have their doubts, particularly when considering robust competition from wallet apps dealing in dollars. “I don’t believe that it moves Facebook up the curve, particularly when compared with the Pays, who leverage the NFC infrastructure and have robust and fully operational wallets,” says Peterson.