Top executives at FIS Inc. early Tuesday reported accelerating revenue in 2024 and see that momentum carrying into the new year, but the energy appears to be coming from financial technologies apart from the big Worldpay merchant-processing platform.

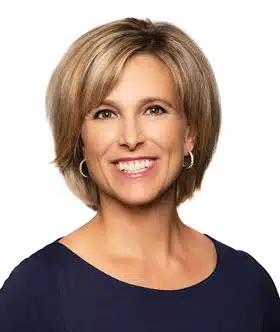

“Worldpay has not been a growth driver in 2024, and won’t be in 2025 because we expect it to be slightly down,” noted FIS chief executive Stephanie Ferris while presenting the company’s fourth-quarter and full-year results during a conference call with equity analysts. “It’s not a contributor to growth.”

FIS owns a 45% stake in Worldpay after selling off a majority interest in the platform to the private equity firm GTCR in 2023. The spin-off took effect in January last year. FIS had acquired the massive processor in 2019 for $43 billion, before Ferris took over as CEO.

FIS reported Tuesday that its revenue from Worldpay increased 4% year-over-year in the fourth quarter, but that growth “lagged expectations,” chief financial officer James Kehoe said on the call. FIS’s stake in the processor is expected to yield $140 million in revenue this year, Kehoe said, but that number will be “slightly down” the following year, he added, echoing Ferris’s forecast.

FIS’s current outlook for Worldpay, one of the world’s biggest merchant processors, stands in sharp contrast to the sunnier mood Ferris and Kehoe struck during the last FIS earnings call in November. Then, Ferris had said the processor was “performing better than when we had it.”

And on Tuesday the top brass reiterated that the Worldpay business is solid. “Worldpay had a very good fourth quarter,” Kehoe said, adding it has had a “strong start in the first quarter.” All told, he said, “the business is doing very well.”

Overall, revenue growth for FIS last year was 4%, up from 3% the prior year as the company concentrated on its technology for financial institutions and capital markets. In a big move, the company announced Tuesday it will integrate into its banking-technology offering “pay-over-time” capability from buy now, pay later specialist Affirm Inc. The service will allow clients to link the service to client banks’ debit cards in what Ferris called a “first of its kind” arrangement.

The company’s stress on its digital offerings for banks, she added, is starting to pay off. “We continue to see a lot of demand,” she said. “Every bank is concentrating on digital.” This is particularly true, she said for finance departments. “We see a huge amount of demand in the office of the CFO” at client banks, she said. To meet that demand, Ferris said FIS is launching a product called “office of the CFO,” technology aimed at helping bank officers “modernize finance functions.”

All told the banking division generated $1.72 billion in revenue in the quarter, up 2% year-over-year. This unit supports banks’ card and ATM programs. The company’s other unit, capital markets, generated $821 million in revenue, up slightly from $820 million in the year-earlier quarter. Overall for FIS, revenue totaled $2.5 billion in the quarter, up 4%, with 78% of revenue recurring. Revenue for the year was $9.9 billion, up 4%, with recurring revenue at 80%.