Credit cards historically have either been secured by a deposit or tied to a credit limit that remains fixed over time. On Friday, a Toronto-based payments-technology provider announced it is developing an unsecured card that comes with a credit line that varies with cardholder behavior.

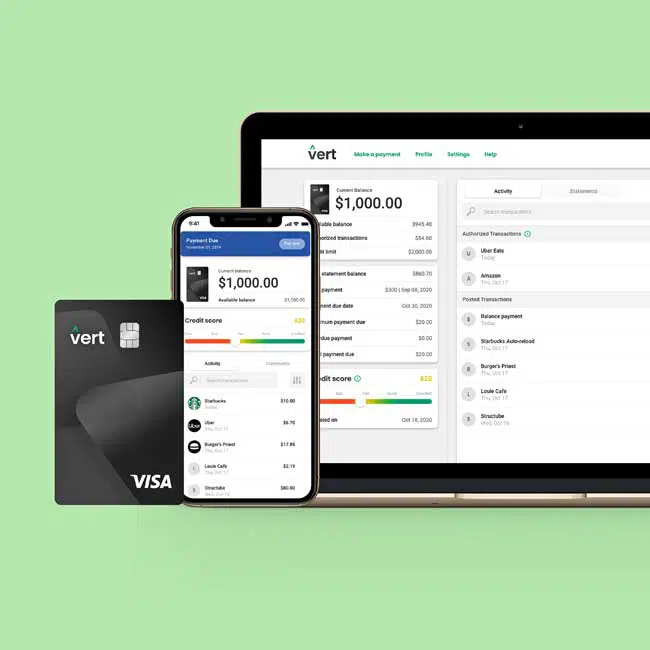

The Visa-branded Vert card, managed by XTM Inc., works with a mobile wallet and uses an artificial-intelligence tool to manage available credit over time and as usage varies, says Marilyn Schaffer, the company’s chief executive. With enough input and with cardholders with widely varying day-to-day behavior, a single credit line could change by the week, she says.

The AI engine takes in a wide variety of data to make these calculations. Some of the indicators can be less than conventional. Schaffer points out, for example, that among the data the AI app considers is the phone’s battery life. Chronically low juice in the battery could indicate that the user is “not organized, not planning properly,” Schaffer says.

XTM plans to launch the card either by the end of December or early next year. The issuer of record is DC Bank, a 13-year-old institution based in Calgary, Alberta. But funding for the card comes from investors in a Special Purpose Vehicle backed by investors instead of a bank. A bank is the issuer of record to satisfy card network rules. “We’re definitely among the first” to launch an unsecured card managed by an AI engine that monitors cardholder behavior, Schaffer says. She admits the concept can sound “creepy,” but adds it can work as much to the cardholder’s advantage as to his or her disadvantage.

XTM began working on the card a year ago as an effort to find a way to get a credit card into the hands of more consumers. The company in the meantime set up a product for service businesses like restaurants that allows servers to access their gratuities via a mobile app and a prepaid Mastercard. Schaffer says that program and others XTM has launched have attracted “hundreds of thousands” of users. “The next natural migration for us is to offer a small unsecured line of credit,” she says.

XTM’s other technology gambit involves a so-called reverse ATM that allows users to insert cash and withdraw a prepaid card. That venture, launched in October, has deployed machines at Toronto’s Scotia Bank Arena, where the Toronto Raptors National Basketball Association team and the Toronto Maple Leafs of the National Hockey League play.