Zelle, the peer-to-peer payment network operated by Early Warning Services LLC, announced early Thursday that consumers and small businesses sent $481 billion dollars over the network during the first half of 2024, a 28% increase from the same period a year ago.

Zelle users sent $1.8 million per minute, $110 million per hour, and $2.6 billion per day in the first half of 2024, the network says. In comparison, Zelle users sent $2.1 billion per day, $87 million per hour, and $1.4 million per minute during the first half of 2023.

In addition to increased dollar volume, the number of transactions during the first half of the year totaled 1.7 billion, up 27% year-over-year. The number of Zelle users at the end of the first half totaled 143 million, up 17 million from the same period a year earlier.

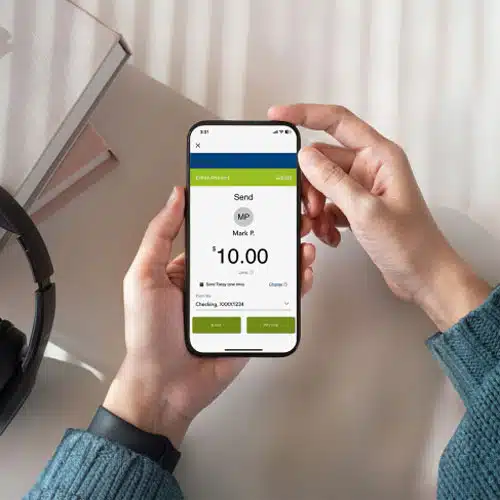

Zelle attributes its growth during the first half to the convenience, speed, and security with which consumers can send and receive funds over its network.

“Zelle fills a vital need for millions of American consumers, solopreneurs, and small businesses who choose the platform to send money to people they know and trust,” Zelle General Manager Denise Leonhard, says by email. “We’re confident about our continued growth because we are working every day to be the largest, most secure, and most trusted P2P platform in payments.”

Zelle currently has more than 2,200-member financial institutions, 95% of which are community banks and credit unions.

Instances of fraud scams being perpetrated on the network also are down, Zelle says. From 2022 through year-end 2023 reports of fraud scams on the network decreased 50%, resulting in 99.95% of Zelle payments in 2023 being completed without any reports of fraud or scams, the network says.

Zelle began coming under fire from legislators in Congress in 2022 over reports that its users were becoming targets of fraud rings. Pressure to correct the problem forced financial institutions within the network to begin providing refunds to users victimized by fraudsters.

As part of its efforts to reduce fraud, Zelle has deployed new technology to help reduce potential fraud across the network, and embarked on a consumer education campaign about how to guard against fraud.

On the consumer education front, the network has launched campaigns with the Better Business Bureau Institute for Marketplace Trust, the National Council on Aging, and the Aspen Institute, a non-profit organization focused on humanistic studies.

“We work to protect Zelle users from fraud and scams through a multilayered security approach – through our technology, consumer education and private-public partnerships,” says Leonhard.

One fraud fighting technique being employed by Zelle is requiring all member financial institutions to use authentication and enrollment controls. Those controls can include requiring the use of usernames, passwords, biometric data, encrypted identity verification data, real-time monitoring of enrollment tokens and data-driven technology

“Zelle also provides data-driven insights for participating financial institutions to help them identify potentially suspicious payments,” Leonhard says.

Another fraud fighting tool by Zelle is direct messaging to users. In 2023, the network sent more than 700 million in-app messages to consumers reminding users to “only pay people they know and trust,” according to Leonhard

In total, Zelle educated 40 million users about potential fraud risks in 2023, Leonhard adds.