Zip Co. Ltd. launched the Zip Card, a physical card to complement its virtual card in the highly competitive buy now, pay later arena.

The new card, to be issued by WebBank, a Salt Lake City-based industrial bank that works with brands like Dell Financial Services, CAN Capital, Klarna, Fingerhut, Shopify, and Toast, is not a credit card, Zip says.

“Zip launched its pilot Zip Card in 2020 to a limited number of customers,” a Zip spokesperson says in an email to Digital Transactions News. “The response was so encouraging that they are now expanding its offering on an invitation basis to all its customers.”

“Zip Card is the next step in delivering on our mission to be the first choice of payment for consumers everywhere they shop—whether it’s online or in-store,” Brad Lindenberg, Zip U.S. co-chief executive, said in a statement.

The addition of a physical card should make it even easier for consumers who use Zip’s BNPL service. Zip users already can load the Zip virtual card into their Apple Wallet or Google Pay smart-phone wallets and use contactless payments at the point of sale to complete an in-store BNPL transaction.

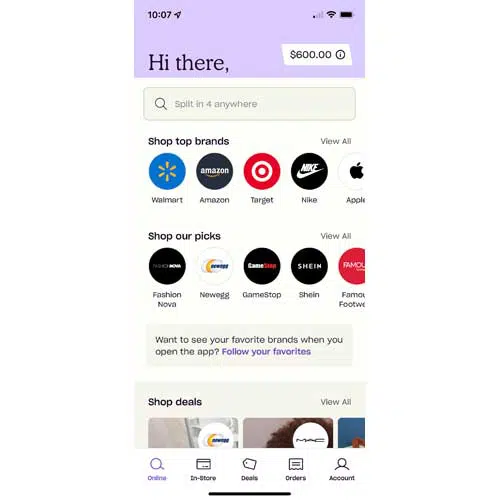

Zip users can request the physical card from within the Zip app. Zip says transactions made with the card are funded from the consumer’s linked debit card every two weeks. Shipments of the Zip Card will begin soon and continue through 2022, Zip says.