Five months after announcing its deal to acquire buy now, pay later provider Afterpay Ltd., Block Inc. is making Afterpay available to Square sellers in the United States and Australia. The move comes as Block, Square’s parent company, officially closed the Afterpay acquisition on Monday. Block agreed to buy Afterpay last August for $29 billion.

The rollout of Afterpay to Square sellers is expected to help them capture more sales among Gen Zers and Millennials, as well as larger ticket purchases. Those two demographics represent about 75% of BNPL users, according to Square. Overall, nearly 56% of U.S. consumers have used a BNPL service.

“Using Afterpay on our Square-powered Web site has been a huge boost to business,” Jeannie and Kendall Glenn, owners of Kendall’s Greek Smartwear, say in a prepared statement. “Our purchases are nearly 20% larger when shoppers use Afterpay and we receive earnings instantly in our Square account to keep our business moving.”

Other consumer benefits from offering Afterpay, the Glenns say, include the ability for customers to earn loyalty points through Square’s loyalty program. “And we’ve been able to engage and convert more new customers than ever before through e-commerce,” the Glenns add.

As part of the Afterpay rollout, Square sellers can try Afterpay at no additional cost through May 10. Merchants can access Afterpay from their Square Online dashboard. During the promotional period, Afterpay transactions will be processed at sellers’ standard e-commerce processing rates. Square sellers receive their full earnings from each sale immediately. Consumers making a purchase using Afterpay pay over four interest-free installments. Square also plans to make Afterpay available on its developer platform and for in-person payments.

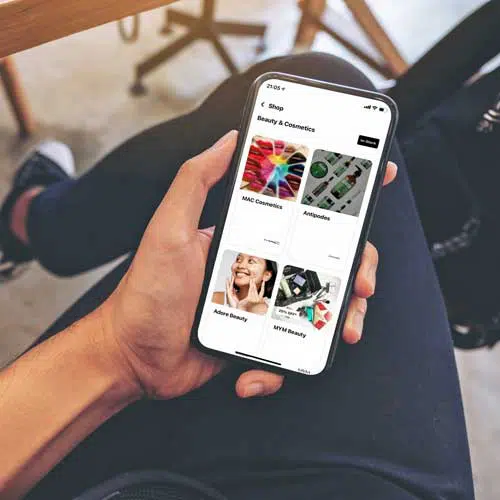

Closing the deal for Afterpay enables Block to offer the BNPL service to all sellers using Square Online for e-commerce in the U.S. and Australia at checkout and gives Afterpay consumers the ability to manage their installment payments directly in Cash App, and gives Cash App users the ability to discover sellers and BNPL offers directly within the app.

As part of the deal, Afterpay cofounders and co-CEOs Nick Molnar and Anthony Eisen are joining Block and will help lead Afterpay’s seller and consumer businesses, respectively, as part of Block’s Square and Cash App businesses.

Block has also appointed Sharon Rothstein, a former Afterpay director and operating partner at growth-equity firm Stripes, to serve as a member of its board of directors.